Main functions

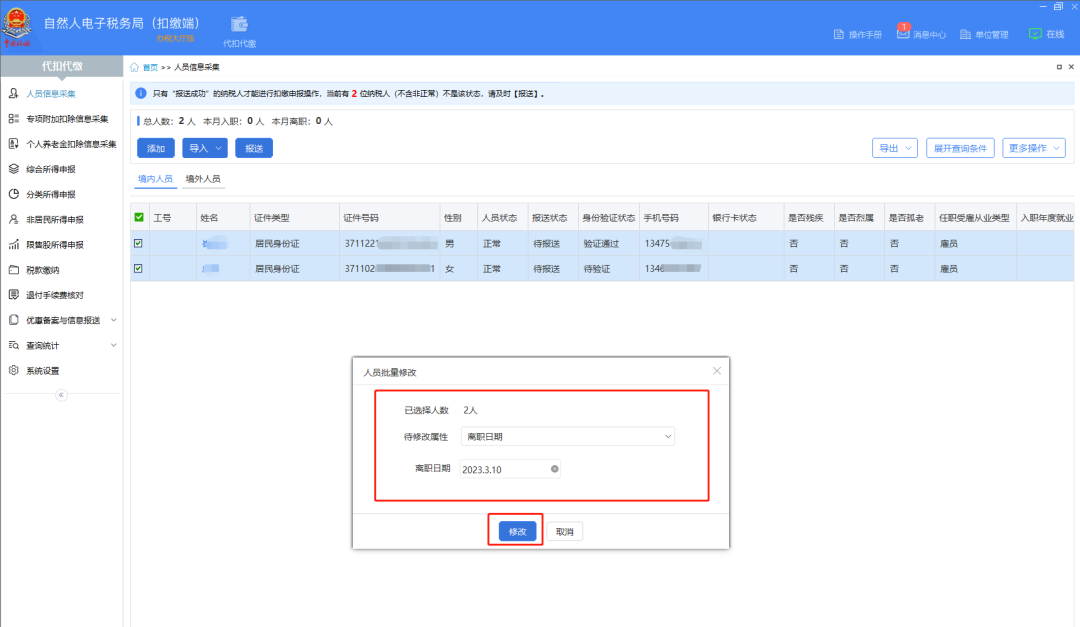

Personnel information collection: used to collect and maintain basic information of unit personnel, such as name, nationality, certificate type, certificate number, gender, mobile phone number, etc., and report and obtain feedback results. This information is the basis for filing personal tax returns.

Report filling: including filling in the withholding income tax report form, filling in the attachments, etc. Among them, the withholding income tax report form is mainly used to fill in the nine items of income that require withholding and payment declaration, such as wages, salary income, labor remuneration income, etc. Filling in the schedule includes filling in the schedule of exemptions and exemptions and commercial health insurance.

Declaration form submission: Provides functions such as sending declarations, obtaining feedback, printing, reporting corrections, and invalidating declarations. Users can operate according to the system prompts and the actual situation of the unit to complete the submission of the declaration form.

Online payment: including tax payment and historical query functions. Users can pay taxes through this function and check the payment records and status of previous months.

Withholding report form inquiry: Users can conduct detailed declaration inquiry, declaration status inquiry, withholding report form inquiry, etc., and support export and printing functions to facilitate users to view and check the declaration data at any time.

FAQ

If employees of the unit do not collect special additional deduction items in a certain month and only start collecting them in subsequent months, will they pay more taxes?

Comprehensive income is taxed using the cumulative withholding method. For individual employees, more tax may be prepaid before special additional deductions are collected, but the total of the previous months will be cumulatively deducted each time after collection. If the tax is negative, the tax will not be refunded temporarily and will be kept as a credit in the future. The excess will be refunded and the excess will be compensated when making individual annual settlement declarations from March to June of the following year.

How to query the declaration data of previous years?

After the withholding client is upgraded, there are two version modes: "XXXX year" (such as 2018) and "XXXX year and later" (such as 2019 and later). The version mode of "XXXX year" can be used to query historical data and make declarations (including corrected declarations) for the tax period and before; the version mode of "XXXX year and later" is suitable for declarations (including corrected declarations) for the tax period and after.

Natural person tax management system withholding client update log:

1. Sweep the bug out and carry it out to the end

2. The most stable version ever

Huajun editor recommends:

A very good natural person tax management system withholding client, easy to use and powerful, don’t miss it if you need it. This site also providesYujia Accounting,Bank of Communications Online Banking Guide,Smart Accounting and Taxation Assistant,A good boss sells and sells goods,Shangyi Financial SoftwareAvailable for you to download.

Your comment needs to be reviewed before it can be displayed