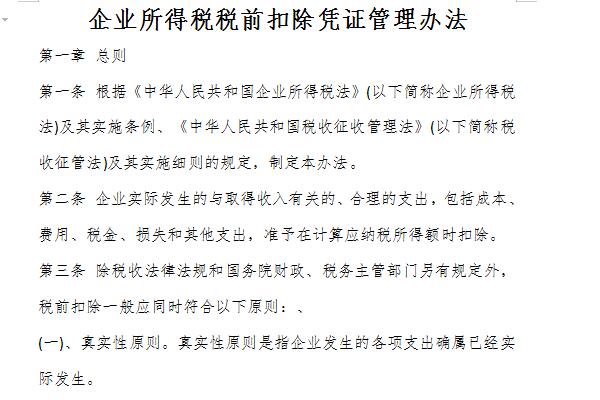

Contents of the Measures for the Administration of Pre-tax Deduction Vouchers for Enterprise Income Tax

Article 1 In order to regulate the management of pre-tax deduction vouchers for corporate income tax (hereinafter referred to as "pre-tax deduction vouchers"), these Measures are formulated in accordance with the Enterprise Income Tax Law of the People's Republic of China (hereinafter referred to as the "Enterprise Income Tax Law") and its implementation regulations, the Tax Collection Administration Law of the People's Republic of China and its implementation rules, the Invoice Management Measures of the People's Republic of China and its implementation rules, etc.

Article 2 The term “pre-tax deduction vouchers” as used in these Measures refers to various types of vouchers used by enterprises to prove that reasonable expenditures related to income are actually incurred when calculating the taxable income of corporate income tax, and based on which pre-tax deductions are made.

Article 3 The term “enterprises” as mentioned in these Measures refers to resident enterprises and non-resident enterprises stipulated in the Enterprise Income Tax Law and its Implementation Regulations.

Article 4 The management of pre-tax deduction vouchers follows the principles of authenticity, legality and relevance. Authenticity means that the economic business reflected in the pre-tax deduction voucher is true and the expenditure has actually occurred; legality means that the form and source of the pre-tax deduction voucher comply with national laws, regulations and other relevant provisions; relevance means that the pre-tax deduction voucher is related to the expenditure it reflects and has probative force.

Article 5 When an enterprise incurs expenditures, it shall obtain a pre-tax deduction certificate as the basis for deducting relevant expenditures when calculating the taxable income of corporate income tax.

Article 6 An enterprise shall obtain a pre-tax deduction certificate before the end of the final settlement period stipulated in the Corporate Income Tax Law of the current year.

Article 7 Enterprises should retain information related to pre-tax deduction vouchers, including contract agreements, expenditure basis, payment vouchers, etc., for future reference to verify the authenticity of pre-tax deduction vouchers.

Commonly used shortcut keys for the management of corporate income tax pre-tax deduction vouchers

Ctrl+Shift+F8: Activate Ctrl+0: Add 12 points of space before each paragraph of selected text.

The column selection function is commonly known as selecting vertical blocks of text (press it again or press the ESC key to cancel this function).

Ctrl+F9: Insert a field symbol "{}" at the cursor (note: a pair of braces entered directly cannot be used as a field symbol).

Ctrl+F5: Restore the window to the state before it was maximized (press it again to maximize the window again).

Ctrl+Deltet: Delete an English word or a Chinese word behind the cursor (can be used repeatedly).

Ctrl+Backspace: Delete an English word or a Chinese word in front of the cursor (can be used repeatedly).

Ctrl+Enter: Quickly move the content behind the cursor to the next page.

The editor recommends:

The Measures for the Management of Pre-tax Deduction Vouchers for Corporate Income Tax is a free template. You can download the source file for you to edit, modify and replace. Huajun Software Park also providesAutomobile Sales Management Measures,Measures for the Administration of Nursing HomesDownload

Useful

Useful

Useful