Financial accounting file management system content

State agencies, social groups, enterprises, institutions and other organizations (hereinafter collectively referred to as entities) shall manage accounting files in accordance with these Measures.

The finance department of the State Council and the state archives administrative department are in charge of the national accounting archives work, jointly formulate a national unified accounting archives work system, and supervise and guide the national accounting archives work.

The financial departments and archives administrative departments of the people's governments at or above the county level manage the accounting archives work within their respective administrative regions, and supervise and guide the accounting archives work within their respective administrative regions.

Units should strengthen the management of accounting archives, establish archives institutions or equip archives staff, establish and improve management systems for the collection, sorting, safekeeping, utilization, identification and destruction of accounting archives, and adopt reliable security protection technologies and measures to ensure the integrity of accounting archives. Authentic, complete, available, and safe.

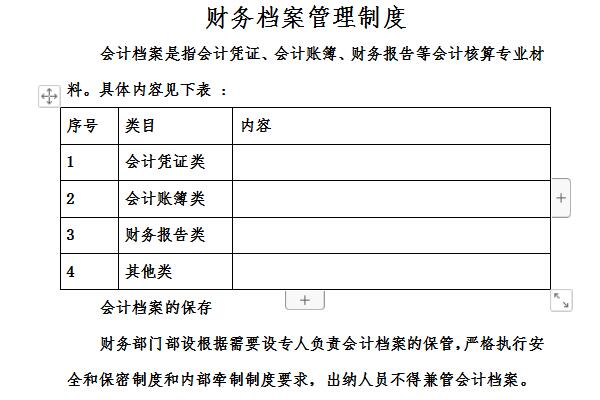

"Accounting files" as mentioned in these Measures refer to various forms of accounting data such as texts and charts that are received or formed by the unit during the accounting process, record and reflect the unit's economic and business matters, and have preservation value. Accounting files generally include paper accounting files and electronic accounting files.

Other matters of financial accounting file management system

The following accounting information should be included in the filing scope:

(1) Accounting vouchers: original vouchers and accounting vouchers.

(2) Accounting books: general ledger, detailed ledgers, journals, fixed asset cards, and other auxiliary account books.

(3) Financial accounting reports: monthly, quarterly, semi-annual and annual financial accounting reports.

(4) Other accounting information: bank balance reconciliation statement, bank statement, tax return, accounting file transfer list, accounting file storage list, accounting file destruction list, accounting file appraisal opinion, and other accounting information with preservation value.

Units can use computers, network communications and other modern information technology means to manage accounting files.

Electronic accounting data generated within the unit, except for detailed accounts (excluding fixed asset cards), can only be archived and saved in electronic form if they meet the following conditions:

(1) The source of electronic accounting data is authentic and valid, generated and transmitted by the information system.

(2) The accounting information system used can accurately, completely and effectively receive and read electronic accounting data; be able to output accounting documents, accounting books, financial accounting statements and other accounting data that comply with national standard filing formats; set up handling, Review, approval and other necessary approval procedures.

The editor recommends:

The financial accounting file management system is a free template. You can download the source file for you to edit, modify and replace. Huajun Software Park also providesSchool network security management system,School health management systemdownload.

it works

it works

it works