1. Online declaration

1. Applicable objects: taxpayers who apply for online declaration and have been reviewed and filed by the tax authorities (except for regular quota households).

2. Applicable tax categories: value-added tax, corporate income tax, flood control and security fees.

3. How to use: Log in to the website of the State Taxation Bureau of the Guangxi Zhuang Autonomous Region, enter [Online Tax Application], click [Online Declaration], enter the taxpayer identification number, login password and click [Login] to declare online.

2. SMS reporting

1. Applicable objects: First, small-scale taxpayers who implement audit collection of VAT; second, taxpayers who apply for SMS declaration and have been reviewed and filed by the tax authorities.

2. Applicable tax categories: value-added tax, flood control and security fees (the system automatically levies flood control and security fees based on the taxable value-added tax income declared by the taxpayer, without the need for taxpayers to declare separately).

3. The special service number for SMS declaration is 12366. Supports China Mobile and China Unicom mobile phone users.

4. The format is: ZZ# Taxpayer Identification Number A Taxable Sales Income A Tax-Free Item Sales Income.

3. Bank online transfer declaration

Applicable objects: Taxpayers who have been approved by the competent tax authorities to collect value-added tax and flood control and security fees on a regular basis. (2) Applicable tax scope: value-added tax.

4. Telephone declaration.

1. Applicable objects: Applicable to taxpayers under the jurisdiction of the Nanning Municipal State Taxation Bureau, firstly, small-scale value-added tax taxpayers who are normal taxpayers in the current month; secondly, other corporate income tax taxpayers except general taxpayers of value-added tax can declare quarterly prepayment of corporate income tax (except for head offices, branches, small low-profit enterprises, and approved collection enterprises).

2. Applicable tax categories: value-added tax, corporate income tax (quarterly prepayment declaration), flood control and security fees.

3. The telephone number of the telephone declaration system is: 12366

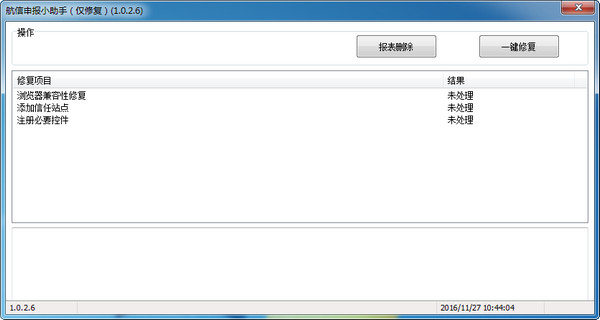

Guangxi District State Taxation Bureau Online Declaration System Declaration Process

Guangxi State Taxation Bureau Online Declaration System Update Log:

1. Modify user-submitted bugs

2.Add new features

Huajun editor recommends:

The Guangxi State Taxation Bureau online declaration system can help you solve many problems. I believe that as long as you dare to use it, you will definitely not be able to put it down. I also recommend it to you.Bank of Communications Online Banking Guide,Smart Accounting and Taxation Assistant,Zhuo Zhang Financial Software,A good boss sells and sells goods,Shangyi Financial Software

Useful

Useful

Useful