Individuals receiving year-end bonuses should calculate and pay personal income tax based on one month's wages and salary income separately, and calculate the tax payable according to the following method: first divide the annual one-time bonus received by the employee in that month by 12, and determine the applicable tax rate and quick calculation deductions according to its quotient to calculate the tax payable. If in the month when the year-end one-time bonus is issued, the employee's wages and salary income are lower than the expense deduction amount stipulated in the tax law, the annual one-time bonus shall be deducted from the balance of the difference between the employee's salary and salary income and the expense deduction amount for that month, and the applicable tax rate and quick calculation deduction amount for the annual one-time bonus shall be determined in accordance with the above method. Within one tax year, this tax calculation method is only allowed to be used once for each taxpayer.

"Notice of the State Administration of Taxation on Adjusting the Methods for Calculating and Collection of Personal Income Tax on Individuals Obtaining Annual One-time Bonuses" (Guo Shui Fa [2005] No. 9 Tax Rate Table for Wage and Salary Income Items Level Full Month Taxable Income Tax Rate % Quick Calculation Deduction Method (yuan) 1 Not exceeding 500 yuan 5 0 2 The portion exceeding 500 yuan to 2,000 yuan 10 25 3 The portion exceeding RMB 2,000 to RMB 5,000 15 125 4 The portion exceeding RMB 5,000 to RMB 20,000 20 375 5 The portion exceeding RMB 20,000 to RMB 40,000 25 1375 6 The portion exceeding RMB 40,000 to RMB 60,000 30 3375 7 The portion exceeding RMB 60,000 to RMB 80,000 35 6375 8 The portion exceeding RMB 80,000 to RMB 100,000 40 10375 9 The portion exceeding RMB 100,000 45 15375

For example: I receive a monthly salary of 2,700 and a year-end bonus of 3,680. How should I pay this month’s personal income tax?

Step 1: Calculate the personal income tax for the current month as 2700-2000=700*10%-25=45 Step 2: Calculate the personal income tax for the year-end bonus as 3680/12=306.67. Compare the tax rate table to find out the tax rate of 5% and the quick calculation deduction of 03680*5%-0=184 yuan. The total personal income tax payable this month is 45+184=229 yuan.

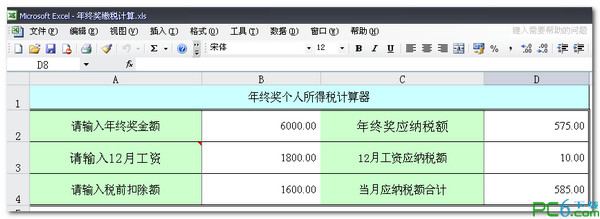

The excel version of this year-end bonus tax calculator has already created the formula, you just need to enter the numbers directly. As shown in the picture

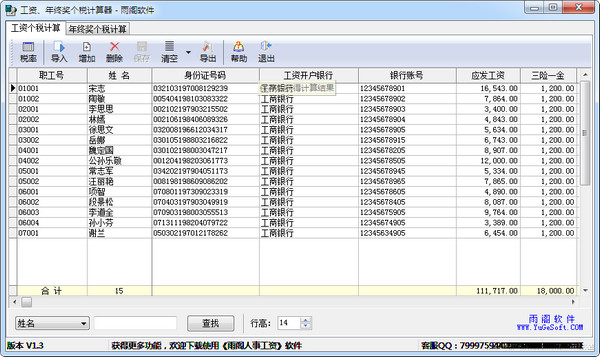

Useful

Useful

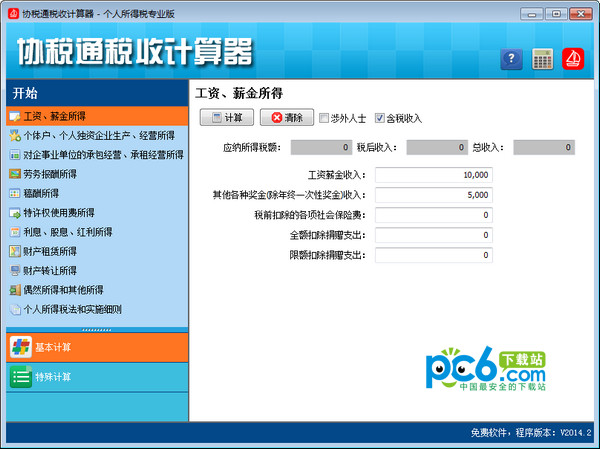

Useful