Software features

(1) Special value-added tax invoices and cargo transportation invoices can be authenticated online; the operation methods for online authentication of both invoices are the same;

(2) When scanning to identify the deduction coupon information, matching scanning parameters are automatically set based on the characteristics of special invoices and freight invoices, without manual adjustment;

(3) It is simple to operate and easy to use. Users with basic computer skills can quickly learn to use it.

FAQ

What are the benefits of online certification to taxpayers?

(1) Taxpayers do not need to go to the national tax authorities to certify special invoices and freight invoices. It turns out that for window authentication, taxpayers have to bring the invoice deduction coupon to the national tax authorities, which requires traveling back and forth, which is time-consuming and not conducive to the safe custody of the invoices. Using the online authentication method, invoices can be authenticated without leaving home, greatly reducing the possibility and trouble of losing invoices.

(2) The authenticity of the deduction coupon can be identified at any time. It turns out that for window certification, taxpayers usually come once at the end of each month. After the certification, it is often too late to discover that there are problems with the invoices, and taxpayers often suffer losses as a result. Through online authentication, taxpayers can know the authenticity of special invoices and freight invoice deduction coupons in a timely manner to avoid economic losses caused by fake invoices.

(3) Eliminate the time and space restrictions on invoice certification. The original window certification required a large amount of one-time certification invoices and a large number of people to certify, resulting in long waiting times for taxpayers and low certification efficiency. The online certification method shortens the distance in time and space between taxpayers and the national tax authorities. Taxpayers can authenticate the special invoice deduction coupons and freight invoice deduction coupons they have obtained online at any time, and there is no need to queue up at the national tax authorities for certification.

What are the special considerations for online certification?

Yes, there are three main points to note:

First, if the taxpayer’s special value-added tax invoice deduction coupons and cargo transportation invoice deduction coupons obtained by the enterprise fall within the scope of tax deduction, they should submit it to the national tax authority for certification through online certification before tax declaration and within 180 days from the invoice date. Otherwise, the deduction cannot be claimed.

Second, if the deduction coupon cannot be authenticated online due to reasons such as wrinkles, rubbing, blurring, etc., taxpayers should submit the original deduction coupon to the competent tax authority for processing.

Third, online authentication of the company’s output invoices and other non-deductible invoices is prohibited.

After online certification, some invoices pass the certification and some fail to pass the certification. What should taxpayers do?

Based on the different certification results of online certification, taxpayers should do the following respectively:

(1) For special invoices or cargo transportation invoices that show "certification passed", taxpayers should print the "Special Invoice Certification Result Notice" and certification list, and the "Freight Invoice Certification Result Notice" and certification list respectively before tax declaration, and bind them together with the original certified deduction coupon on a monthly basis for future reference; and compare the invoices and lists when filing tax returns.

(2) For invoices showing "repeated certification", taxpayers should submit the original invoice deduction coupon to the competent state tax authority for processing within 24 hours after receiving the online certification result information from the state tax authority.

(3) For invoices that show "certification failed", taxpayers should check the electronic information of the invoice and the face information of the paper invoice. If they are inconsistent, correct and re-certify, and then submit the original invoice deduction coupon to the competent state tax authority within 24 hours for window certification.

What preparations do companies need to make for online certification?

(1) A computer with Internet access, the computer configuration is: Pentium III processor above 1GHz, memory above 256M, hard disk above 1G, USB interface, and WINDOWS2000/XP operating system.

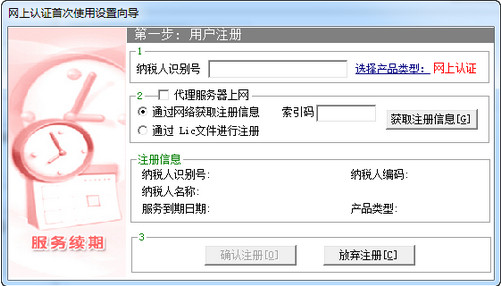

(2) Install online certified enterprise software and provide training to operators.

(3) Choose suitable scanning equipment.

Where can I get training for online certification operations? How is the after-sales service?

(1) Taxpayers who need to apply for online certification can contact the local authorized service unit of Hangzhou Zhongtian Software Co., Ltd. for training. The local service unit provides online certification enterprise software and corresponding scanning equipment.

(2) The taxpayer signs a technical service agreement with the local authorized service unit to obtain after-sales service.

(3) Taxpayers can log on to the website http://www.hzztsoft.com to check the contact information of local service units, or call 0571-81951313 for consultation.

Useful

Useful

Useful