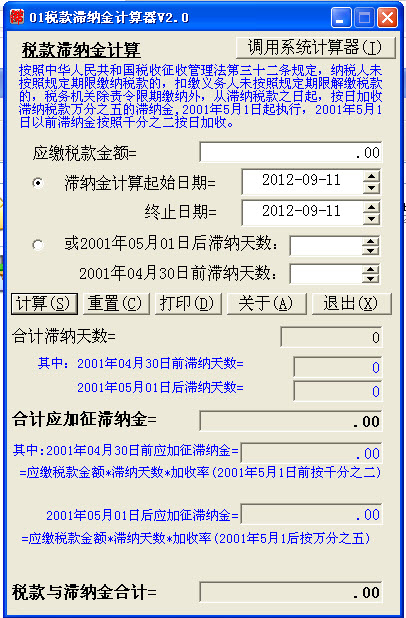

The tax late payment fee calculator is suitable for use by individuals, enterprises, public institutions, accountants, auditors, tax accounting firms, various consulting and brokerage agencies, and tax authorities at all levels. It can easily calculate tax late payment fees. The number of late payment days can be calculated according to the provided The starting date is automatically calculated, and the number of days overdue can also be directly entered. It also supports an additional charge rate of two thousandths before May 1, 2001.

Tax Late Fee Calculator Software Features

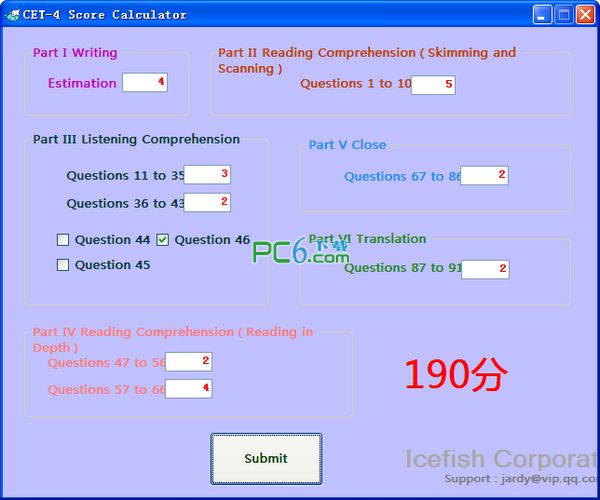

1. The tax late payment fee calculator supports the calculation of 11 categories of personal income tax, including wages and salary income (including monthly salary, annual one-time bonus income, enterprise annuity, economic compensation, retirement payment), individual industrial and commercial household production and operation, For enterprises and institutions’ income from contracting and leasing operations, labor remuneration income, etc., the calculation of tax rates under the old and new tax laws before and after September 1, 2011 is supported.

2. The tax late payment calculator also has a teaching function. It not only calculates the final result, but also displays the calculation formula, each intermediate step, and the corresponding laws and regulations. The calculation results are clear and easy to understand.

3. The unique back-calculation function can back-calculate the pre-tax income or the after-tax income based on the tax payable to calculate the tax payable.

4. It has a tax late payment fee calculation function and supports two different late payment fee increase rates before and after May 1, 2001.

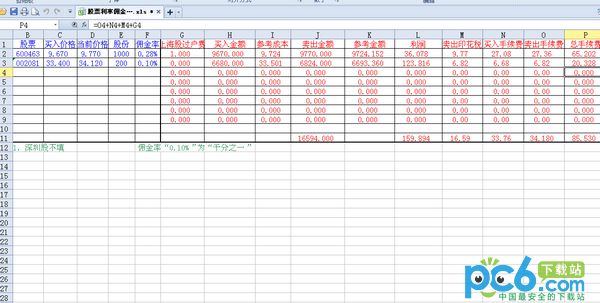

5. Comes with an EXCEL salary table designed by the author, which can facilitate registered users to calculate personal income tax withholding in the unit's salary table and print salary slips.

6. Customized website link function, you can define your frequently used website links in the software help menu to facilitate daily use.

7. The system calculator quick call function can quickly call the calculator that comes with the operating system in the tax late payment fee calculator, which is convenient for daily calculations.

it works

it works

it works