Introduction to online tax declaration system software

The Beijing State Taxation Online Tax Declaration System is a data/information operation platform that integrates report design and processing, data collection functions, data management mechanisms, formula compilation systems, data analysis and summary, and network transmission tools. The system supports multiple reporting methods, namely reporting through the Internet, reporting directly to CTAIS using storage media, etc. Create a safe and reliable online declaration environment for taxpayers, and truly realize a secure online declaration platform that integrates tax information transmission, processing, management, release, browsing, query and security protection.

This system is a data/information operation platform that integrates report design and processing, data collection functions, data management mechanisms, formula compilation systems, data analysis and summary, network transmission and other tools. The system supports multiple reporting methods, namely reporting through the Internet, reporting directly to CTAIS using storage media, etc. Create a safe and reliable online declaration environment for taxpayers, and truly realize a secure online declaration platform that integrates tax information transmission, processing, management, release, browsing, query and security protection.

Online tax declaration system software functions

User management: including functions such as creating new users, changing passwords, deleting users, updating certificates, deleting certificates, etc.

Information management: including the functions of receiving, reading, deleting, importing, and exporting tax authority messages.

Create a new tax collection period: The user obtains the tax types and related data that should be reported for this period from the remote server (tax bureau), and establishes a corresponding tax collection period.

Filling in tax information: For the convenience of taxpayers, the system provides a variety of forms for filling in tax information. Taxpayers can enter it themselves, or they can import existing data that conforms to the system's standard interface format. When filling out reports, taxpayers should fill in the contents of various reports in the correct order. Taxpayers can modify the data in the table before the tax authorities officially receive the declaration data. Report types are divided by tax type: value-added tax, consumption tax, business tax, personal income tax, withheld income tax, income tax, immediate refund of income tax, etc.; by frequency, they are divided into: anytime report, monthly report, quarterly report, and annual report. During the process of filling in the report, the system will automatically verify the type, length and calculation relationship of the data items in the report, and provide error prompts and help for filling in the data items. .

Declaration to the tax bureau: Only after all reports for the current period have been completed can the declaration be made to the tax bureau. During the declaration process, the system will automatically verify the balance between reports and the balance between reports and payment documents.

Cancel the declaration: After the declaration is successful, if the declaration data is found to be incorrect, you can cancel the declaration data and declare again before the payment is deducted.

Deductions from tax and treasury banks: Taxpayers who have signed a tripartite agreement with tax and treasury banks can use this system to deduct money online.

Printing reports: Provides printing of empty forms and printing of reports with filled in data.

Browsing reports: Users can browse the reports within the period without following the normal filling order. Users are not allowed to fill in the reports opened under this function.

Data backup and recovery: The backup and recovery operations of completed tax declaration information can realize the transmission and review of tax declaration information between different computers.

Help: including system help, system log viewing, and operation error information viewing.

Download updates: When the user runs the system, the system automatically detects whether the software you are using needs to be updated, and the user can update the software as needed.

Online tax declaration system installation steps

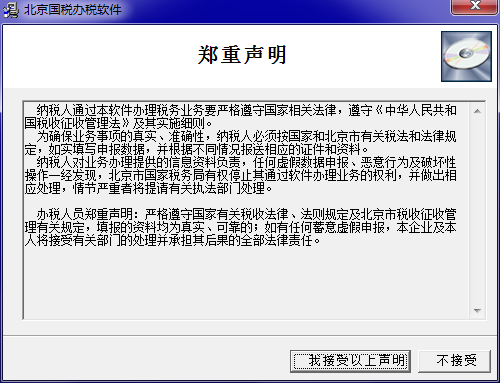

1. Download the official version of the online tax declaration system installation package from Huajun Software Park, and extract it to the current folder. Click the .EXE application to enter the installation wizard interface, and then click Next.

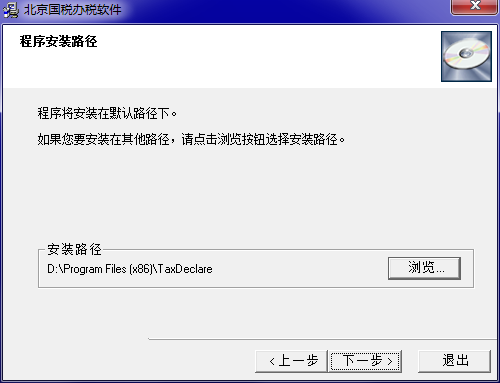

2. Select the software installation location interface. The editor of PC Download Network recommends that users install it in the D drive, select the installation location and click Next.

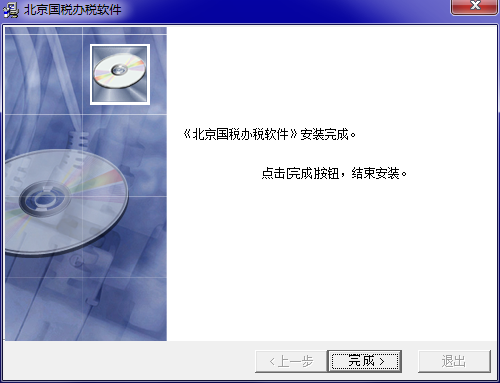

3. The installation of the online tax declaration system is completed, click Finish.

Online tax declaration system update log

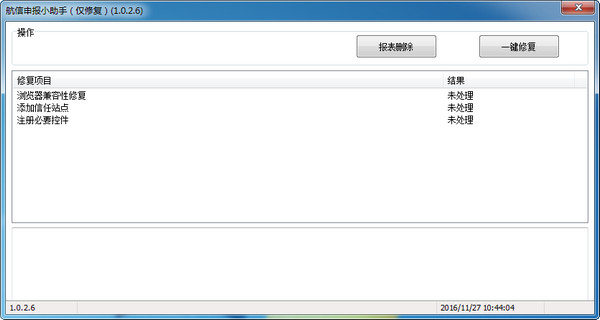

1. Optimize content

2. The details are more outstanding and the bugs are gone.

Huajun editor recommends:

Huajun Software Park also has popular software with the same functions as this software, such as:National tax electronic tax service platform,Litigation Fees Calculator,National tax integrated tax processing platform,Local Taxation Electronic Taxation Bureau Client,Civil Trial Assistant Plug-inWait, you can collect it if you need it!

Useful

Useful

Useful