Platform introduction

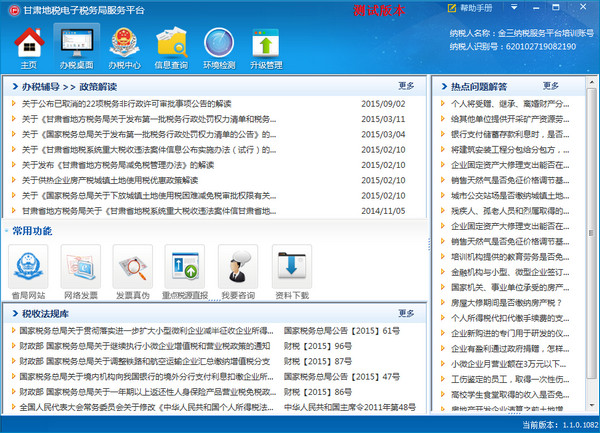

According to the different needs of taxpayers, the new version of the online tax service hall is divided into four functional areas: user login, information push, business processing, and related links.

Among them, "User Login" is the entrance for taxpayers to use the CA digital key to log in to the system to handle business; "Information Push" is used to push relevant notices and announcements, policy interpretations, special taxation knowledge and other content to taxpayers; the related link area is used to provide Hubei National Taxation official WeChat, Weibo, website map, 12366 hotline, mobile taxation platform, Hubei Local Taxation QR code or website link.

1. In the "Business Processing" area, from the perspective of facilitating taxpayers' tax processing, the original tax processing systems are reclassified into four modules: "Tax Processing Services", "Tax-related Inquiry", "Collection Interaction" and "Download Center".

2. "Tax service": tax declaration and payment, other declarations, online issuance of payment vouchers, remote declaration of export tax refunds, online invoice issuance, online invoice collection, issuance of motor vehicle sales invoices, handling of tax-related matters and self-service tax processing.

3. "Tax-related inquiry": Invoice inquiry, basic information inquiry, tax declaration inquiry, tax regulations inquiry, tax map, and tax credit status inquiry.

4. "Collection interaction" includes: tax consultation, online classes, taxpayer needs survey, tax handling guide, service complaints, and tax-related reports.

5. "Download Center" includes: form download and software download.

Function introduction

1. Tax processing center

The tax processing center includes four modules: tax declaration, declaration invalidation, tax payment, and my information. This interface lists all the declared taxes that taxpayers need to declare, and integrates the functions of invalidation, payment, and query of treasury transaction status into this page. The interface is displayed in the form of a menu, as shown in the figure below. The functions here cover the TIPS status query, declaration and payment function modules, and financial statement function modules of the original client system.

Tax declaration:

Displays the tax type information that taxpayers need to declare. Among them, the four reporting channels of real estate tax, urban land use tax, vehicle and vessel tax, financial statement submission, and general declaration are brought out by default and do not require qualification identification.

Click above to re-obtain the declaration list to update the newly recognized tax and fee information.

Declaration invalid:

There are two modules for invalidating declarations, among which [Voided Declaration (Individual Tax)] only invalidates personal income tax declaration information, and [Voided Declaration] invalidates declaration information other than personal income tax.

Tax payment:

Tax payment consists of two modules. [Tax payment] displays the declaration information of taxpayers who have declared but not paid. Taxpayers can select the declaration information that needs to be paid for online deduction. [Deduction Status Query Processing] Query the status of deduction operations initiated by taxpayers. If the deduction result is in an unknown status, it can be unlocked through this function module.

My information:

The page displays five basic taxpayer information: taxpayer registration information, tax category identification information, exemption information, prepayment information, and invoice inventory information. Its functions cover my information and tax assessment information functions under the original system information query function module.

2. Information inquiry

This functional module includes two functional modules: comprehensive query and declaration and collection query. Comprehensive query mainly includes: overdue tax information query, ticket type approval query, tax refund information query, data submission report information query, invoice purchase query, certification information query, etc. A total of 22 data queries; declaration and collection query includes 3 data queries: payment information query, declaration information query, and financial statement submission query

For more detailed introduction, please refer to the Gansu Local Tax Online Tax Service Platform Installation and Operation Guide (Golden Tax Phase III Optimized Version).doc included in the software package

Useful

Useful

Useful