Applicable areas

The version released this time is applicable to the following pilot areas of the third phase of the Golden Tax:

1. Shanxi Province

2. Shandong Province

3. Chongqing City

Note: Please refer to the notice from the local tax authority.

Pilot technical support

In order to ensure that pilot enterprises can successfully complete the export tax refund declaration work, the export tax refund declaration system now provides the following technical support services. If any enterprise users encounter any problems during the trial operation, they can obtain help through the following methods.

Technical support phone: 400-6186661 ext. 6

Technical support group number: 283276337 (Shanxi dedicated group) 315226074 (Shandong dedicated group)

Technical support website: China Export Tax Refund Consulting Network

Technical Support for Tax Refund: When the customer service phone number and QQ group are crowded, you can use "Tax Refund" to contact customer service staff in a timely manner to solve the problems you encounter more conveniently and quickly.

Instructions for using the Tax Refund Pass:

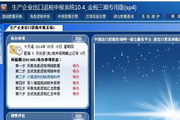

1 Users can directly start the production/foreign trade declaration system and click the "Online Customer Service" button at the bottom right of the main interface to start the "Tax Refund Link".

2. If you are a user who has registered on the China Export Tax Refund Consulting Network, you can directly use your registered account to log in to "Tax Refund Channel" for technical consultation.

3. If you do not have an account, please click "Register Account" in the "Tax Refund" startup interface to enter the registration page, and follow the prompts to register an account. After successful registration, you can use your account to log in to "Tax Refund" for technical consultation.

it works

it works

it works