- Green versionCheck

- Green versionCheck

- Green versionCheck

- Green versionCheck

Features

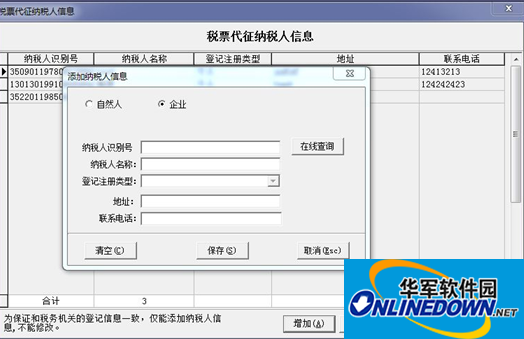

The main ones include: adding natural person registration and tax exemption functions; revamping the process of issuing tax invoices. After issuing tax invoices, the client needs to actively report data to the Jinsan system and initiate deductions.

The prerequisite for using this software is that the entrusted collection unit has signed an entrustment collection agreement and a three-party deduction agreement in the third phase of the Golden Tax, has identified the tax types, and has issued tax invoices to the collection unit.

Software description

Entrusted collection means that the tax authorities entrust relevant matters in accordance with the requirements of the "Tax Collection Administration Law" and its implementation rules to facilitate tax control and facilitate tax payment, and in accordance with the principles of voluntary collection, simple collection, strengthened management, and entrustment in accordance with the law and relevant national regulations. The act of units and individuals collecting sporadic, scattered and off-site taxes.

Update instructions

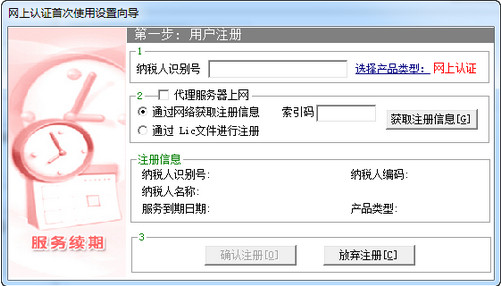

The backend server is switched from Dragon Edition to Golden Tax Phase III;

Delete the invoicing function;

All taxpayers subject to collection must register;

After issuing a tax invoice, the collection agency must report the invoicing data to Jinsan and initiate deductions.

it works

it works

it works