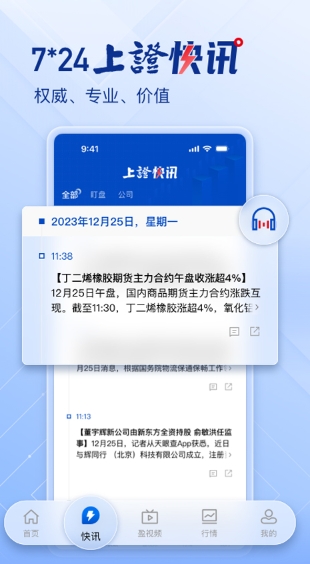

Shanghai Securities News Highlights

Information efficiency revolution

The "information collection - data cleaning - analysis and modeling" process in traditional investment research is compressed to the minute level. For example, a user from an institution used the "Industry Chain Map" function of the App to locate 12 core suppliers of photovoltaic inverters within 30 seconds.

By replacing some functions of the traditional Wind terminal, the annual usage cost of small and medium-sized investors can be reduced by more than 80%.

Regulatory Technology Applications

The built-in "compliance self-examination" module scans user positions in real time to see whether they trigger new holding reduction regulations, short-term trading red lines, etc., and has warned of potential violations more than 50,000 times.

Cooperated with the Shanghai and Shenzhen Stock Exchanges to develop the “Public Opinion Heat Index” to capture the turning point of market sentiment 2 hours in advance and assist regulatory authorities in predicting risks.

Features of Shanghai Securities News

Market warning: Supports customization of price increases and decreases, turnover rate, and capital flow thresholds. When conditions are triggered, triple reminders will be sent via App + text message + voice call.

Social function: The built-in stock friend circle supports the posting of real orders and PK of opinions, and the average daily discussion volume of hot topics (such as "Can the AI computing power sector be relayed") exceeds 100,000.

Barrier-free Adaptation: A voice broadcast mode is developed for visually impaired users, which can read market data and research report summaries aloud, and the voice recognition accuracy reaches 98%.

Investment advisory service: Access to more than 600 licensed investment advisors, providing services such as paid Q&A (starting at 9.9 yuan per time), portfolio follow-up investment (management fee 1%/year), and user satisfaction reaches 92%.

Event Operations: Regularly hold simulated stock trading competitions (a single period bonus pool exceeds one million) and new stock subscription strategy meetings, attracting a total of more than 2 million users to participate in 2024.

Shanghai Securities News function

Zero-lag push mechanism

Based on distributed message queue technology, the end-to-end delay from information collection to the user end is controlled within 500ms, and the push speed of major events (such as central bank interest rate cuts) is 30% ahead of peers.

The multi-active data center architecture is adopted to ensure that the system availability reaches 99.99% under extreme market conditions (such as the daily limit/low limit of 1,000 stocks) and the market query response time is <200ms.

Privacy and Compliance Guarantee

It has passed the national level 3 certification. User position data is encrypted and stored in a private cloud. Sensitive operations (such as bulk transaction reminders) require double biometric verification.

In strict compliance with the "Personal Information Protection Law", user subscription preference data is only used for content recommendation and is prohibited from being shared with third parties.

Information service system

Structured Classification: Build a four-level information system of "macro-industry-company-market", covering global markets such as A-shares, Hong Kong stocks, and US stocks, and support users to subscribe to in-depth reports by industry (such as new energy, semiconductors) and sectors (Science and Technology Innovation Board, Beijing Stock Exchange).

Personalized customization: Intelligent recommendation of related information based on user position data. For example, users who hold Kweichow Moutai stocks can get priority access to liquor industry policy interpretations and competitive product trends.

Authoritative Content Matrix: Relying on the editorial resources of Xinhua News Agency and Shanghai Securities News, more than 200 exclusive news items are published every day, covering core information sources such as listed company announcements, regulatory developments, and executive interviews.

Quote Tool Chain

Millisecond-level data: Connect to the Level-2 market of the Shanghai and Shenzhen Stock Exchanges, supporting in-depth data such as ten levels of handicap, transaction by transaction, capital flow, etc. The market refresh rate reaches 0.1 seconds/time.

Full index coverage: Real-time presentation of more than 30 core indexes such as the Shanghai Composite Index, Shenzhen Composite Component Index, and GEM Index, and simultaneously provides minute-level trends of emerging market indices such as Science and Technology 50 and Hang Seng Technology.

Correlation Analysis Tool: Individual stock market pages are embedded with F10 data, research report ratings, and Dragon and Tiger List data, allowing users to jump to view the dynamics of upstream and downstream companies in the related industry chain with one click.

Intelligent decision-making assistance

AI Forecasting System: Use NLP technology to analyze massive research reports and output individual stock profit forecasts, valuation ranges and risk ratings. The historical forecast accuracy rate exceeds 65% (taking Shanghai and Shenzhen 300 constituent stocks as a sample).

Event-driven analysis: Automatically capture unstructured data such as policy documents and industry white papers, and generate event impact ratings (such as the potential positive rating of the "semiconductor equipment subsidy policy" for Northern Huachuang).

Portfolio backtesting function: Supports users to build their own stock portfolios, look back at historical data over the past five years, and generate key indicators such as yield curves, maximum drawdowns, and Sharpe ratios.

Shanghai Securities News FAQ

Privacy permission settings are complicated

Phenomena: Users have doubts about the storage, camera, microphone and other permissions applied for by the App, or they are not sure how to close them.

Solution: In the App’s “Settings-Privacy Settings”, users can manage permissions independently. For example, if you refuse to grant camera permission, you will not be able to use the upload picture function, but it will not affect other functions. Users should note that turning off some permissions may result in restrictions on related functions.

Market data is delayed or abnormal

Phenomena: Users reported that the market data was not refreshed in time, or there was lag or slow loading.

Solution:

Check whether the network connection is stable and try to switch the network environment.

Clear the App cache (via the "Settings-Clear Cache" function).

If the problem persists, contact customer service to report specific issues, including time, index type, etc., so that the technical team can troubleshoot.

Shanghai Securities News update log:

1. Optimize content

2. The details are more outstanding and bugs are gone.

Huajun editor recommends:

The operation steps of the Shanghai Securities News software are very simple and very fast, so users can use it with confidence. Also recommendedStock trading with Flush,Harvest Internet,Shizuishan Bank,Jiangnan Rural Commercial Bank,Zhangjiakou BankDownload and use related software.

You may like

You may like

Your comment needs to be reviewed before it can be displayed