-

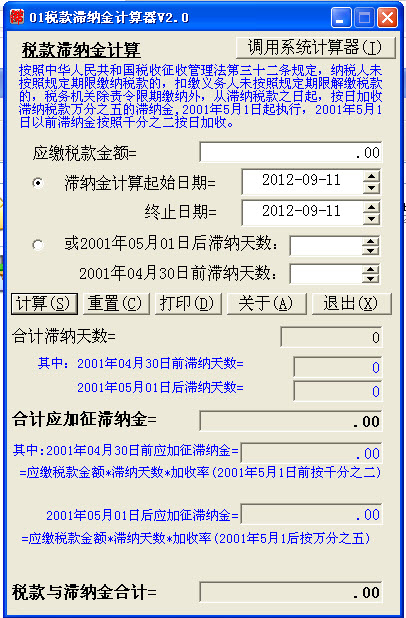

Tax Late Fee Calculator

- Size: 2M

- Language: Simplified Chinese

- category: science tools

- System: winall

Version: 2.0 Green Free Edition | Update time: 2024-09-14

Similar recommendations

Latest updates

How to upgrade 360 Secure Browser? -How to upgrade the version of 360 Secure Browser

How to switch accounts to log in to iQiyi? -How to log in to iQiyi account switching account

How to set Chinese in cs1.6-How to set Chinese in cs1.6

How to adjust the time in cs1.6 - How to adjust the time in cs1.6

How to connect to LAN in cs1.6-How to connect to LAN in cs1.6

How to capture the game with obs? -obs method of capturing games

How to add robots in cs1.6-How to add robots in cs1.6

How to set the encoder in obs? -obs method of setting the encoder

How to set Traditional Chinese in obs? -obs method to set Traditional Chinese

Tax Late Fee Calculator Review

-

1st floor Huajun netizen 2018-01-06 00:26:25The tax late fee calculator is very useful, thank you! !

-

2nd floor Huajun netizen 2020-04-15 07:02:50The overall feeling of the tax late payment fee calculator is good, I am quite satisfied, the installation and operation are very smooth! Followed the installation step-by-step instructions and it went very smoothly!

-

3rd floor Huajun netizen 2020-11-20 16:50:24The tax late payment calculator is pretty good and downloads very quickly. I’d like to give you a good review!

Recommended products

-

MathType

-

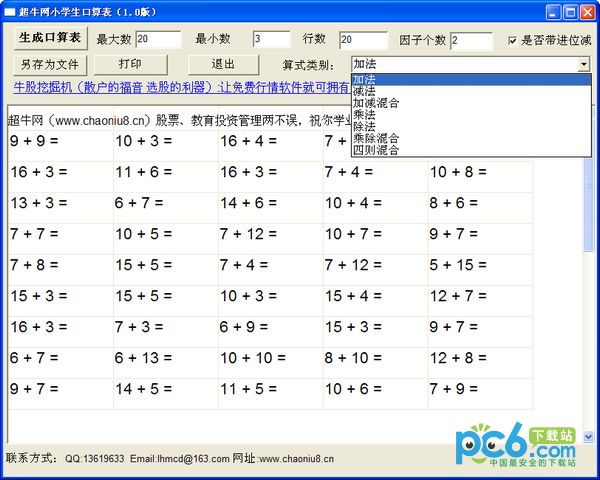

Oral arithmetic problem generator for primary school students

-

Equation Editor Mathematical formula editor

-

yEd Graph Editor

-

Middle School Circuit Virtual Laboratory

-

AxMath

-

math tools

-

Elementary school mathematics question bank

-

Simulation physics laboratory junior high school full version

-

Scientific Calculator Multi-Function Edition

- Diablo game tool collection

- Group purchasing software collection area

- p2p seed search artifact download-P2P seed search artifact special topic

- adobe software encyclopedia - adobe full range of software downloads - adobe software downloads

- Safe Internet Encyclopedia

- Browser PC version download-browser download collection

- Diablo 3 game collection

- Anxin Quote Software

- Which Key Wizard software is better? Key Wizard software collection