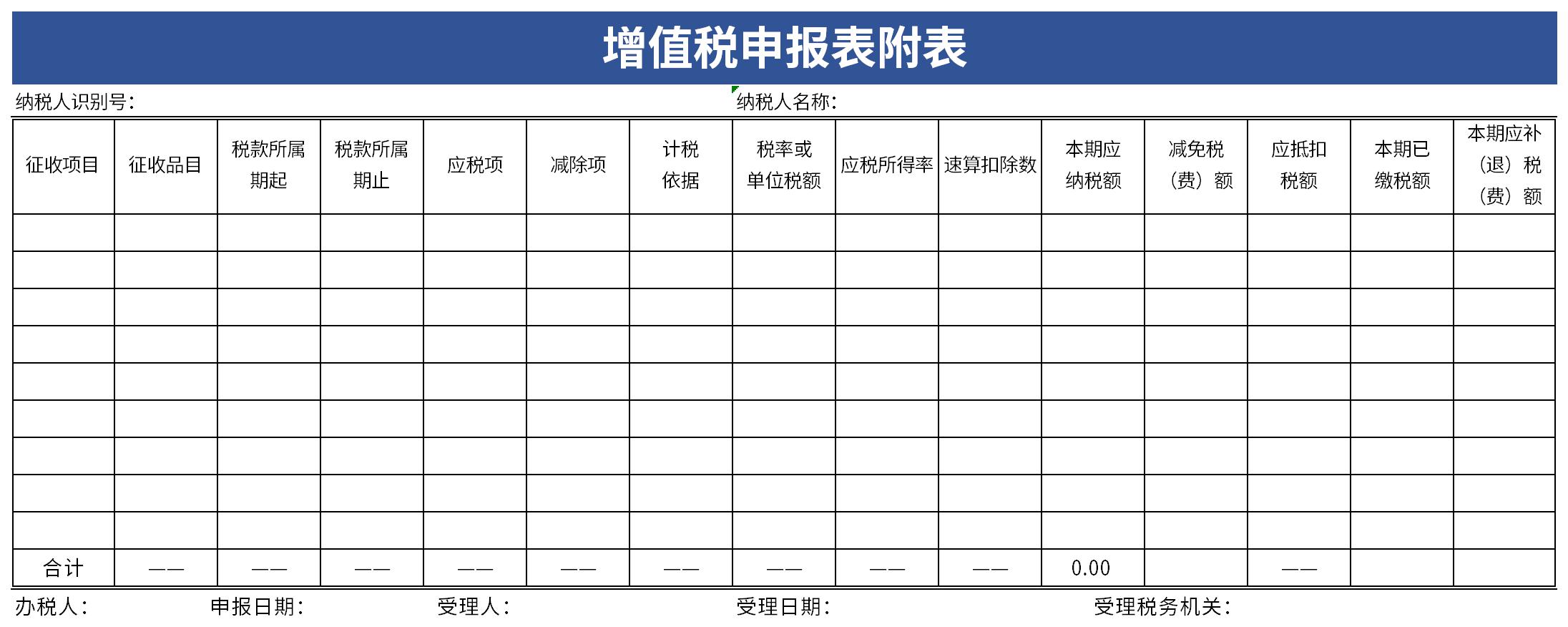

Tips for using Schedule 3 of VAT return

Tips for using Schedule 3 of VAT return

VAT is levied as follows:

General taxpayer

(1) Taxpayers who produce goods or provide taxable services, and taxpayers who mainly produce goods or provide taxable services and also engage in the wholesale or retail of goods, whose annual taxable sales exceed xx million;

(2) Engaged in the wholesale or retail business of goods, with annual taxable sales exceeding xx million yuan.

By pressing alt+Enter after a certain character in a cell, you can force the cursor to the next line.

2: Automatic line wrapping

After typing the text in the cell, find the "Automatically wrap" button on the toolbar and you can freely switch the text between wrapping and not wrapping.

3: Hide the chapter list

Select the first line, hold down [shift+F] to open the "Find and Replace" dialog box, "Remarks to find all, hold down shift+A to select all, then close the dialog box, hold down [ctri+0] to hide

4: Quickly select specific columns

Select the table area, click the "Create from selected content" dialog box under the [Formula] tab, select "First Row", after the settings are completed, open the name box in the upper left corner, click the corresponding list to jump to the specified column.

Two column name verification

If you want to check whether the name in Table 2 appears in Table 1, a formula can be used to do it immediately.

=IF(COUNTIF(A:A,C2),"Yes","No")Recommended by the editor of Huajun Software Park

Schedule 3 of VAT ReturnIt is a very practical form, and most of the forms to be filled in are for general purposes. If you happen to need to download Schedule 3 of the VAT return, please download it quickly. also,Course Registration Application Form,Statistical table of teachers’ age structureIt is also a good form template. You are welcome to click to download and experience it.

it works

it works

it works