VAT invoice issuance software tax UKey versionThe official version is a professional VAT invoicing tool.VAT invoice issuance software tax UKey versionPowerful function, supports the issuance of ordinary VATinvoice, VAT electronic general invoices and VAT general invoices, etc. VAT invoiceInvoicingThe latest version of the software is easy to use, efficient and safe, and is an indispensable tool for citizens and businesses to issue invoices.Huajun Software Park provides you with free download of VAT invoice issuing software (Tax UKey version) 2024. Friends who like VAT invoice issuing software (Tax UKey version) come to Huajun Software Park to download and experience it!

Frequently Asked Questions about VAT Invoice Issuing Software Tax UKey Version

1. Why does it prompt "The number of inspections for this invoice on that day has been exceeded (please check again the next day)!"?

Answer: Each invoice can be checked online 5 times a day. If the number is exceeded, please check again the next day.

2. After entering the verification items, why is the verification code not displayed?

Answer: The possible reasons are as follows:

(1) Please check whether the root certificate is installed correctly. If the root certificate is not installed correctly, the verification code will not be displayed normally;

(2) Please try to useGoogleorFirefoxBrowser to check;

(3) It can be the provincial tax authority that issues the invoicenetworkIf it is caused by an unstable environment or abnormal service and you still cannot verify it after multiple attempts, please contact the tax authority in charge of the invoicing party;

(4) In order to ensure the security of data transmission, some provinces no longer support the IE8 browser under the Windows XP operating system. It is recommended that you use Google Chrome or upgrade the operating system.

3. Why does it display “No such ticket found”?

Answer: The possible reasons are as follows:

(1) The input check items are incorrect;

(2) The invoice issuance date queried is more than 5 years from the current date;

(3) Since the invoicing party issued the invoice offline, the invoice data was not uploaded to the tax bureau;

(4) Invoices issued by non-VAT invoice management systems.

4.Important differences between VAT invoices and ordinary invoices

1. The core of the application is different

Generally speaking, VAT invoices can only be applied for by ordinary VAT taxpayers. If ordinary taxpayers need to use it, invoices can only be issued by the local tax bureau after approval by the tax bureau; general invoices can be applied for by various operators who are engaged in production and business and have registered tax changes.

2. Is tax deduction allowed?

The VAT invoice is not only a voucher for mutual payment of goods sold, but also a voucher for the buyer (general VAT taxpayer) to deduct VAT. Therefore, it not only has the function of civil and commercial certificates, but also has the function of tax payment certificates. Except for the business scope covered by tax laws and regulations, input tax cannot be deducted from ordinary invoices.

The VAT invoice issuance software tax Ukey version is a powerful and easy-to-operate tax management tool. It can help enterprises quickly and accurately issue special value-added tax invoices and provide comprehensive invoice management and query functions. Using this software can greatly improve the work efficiency of enterprises and reduce the workload of financial personnel.

5. How to use the tax Ukey invoicing software to copy tax returns and reverse write data?

Please enter the tax Ukey invoicing software and click [Data Management] - [Data Processing] - [Summary Upload] or in the process navigation window on the home page of the software, click the [Summary Upload] icon button to enter the summary upload window. Please continue to click the "Report Summary" button Carry out the invoice data reporting and summary operation; after successful reporting and summary, you need to complete the VAT declaration and return to the tax Ukey invoicing software. Click the "Reverse Writing Monitoring" button in [Data Management] - [Data Processing] - [Summary Upload] to complete the reverse writing of the invoice monitoring data information.

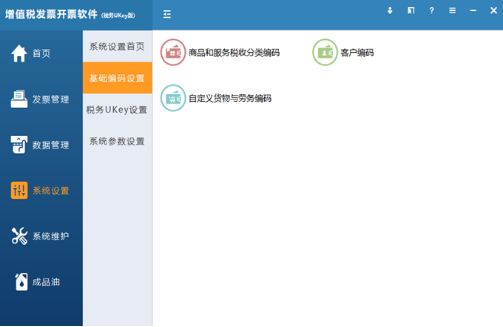

6. How to modify the basic information of the seller in the tax Ukey invoicing software?

Please log in to the tax Ukey invoicing software and click [System Settings] - [systemParameter Settings] - [Parameter Settings] - [Basic Information], fill in the information correctly or obtain the information through "online", click OK, and the information is set successfully.

The taxpayer identification number is the tax number of the enterprise recorded in the tax UKey automatically obtained by the system and cannot be changed directly; the taxpayer name is the name of the enterprise recorded in the tax UKey automatically obtained by the system and cannot be changed directly; the business address, phone number, and bank account number can be filled in manually according to the company's circumstances.

How to decompress VAT invoice issuing software

Download the installation package: Visit the National VAT Invoice Inspection Platform of the State Administration of Taxation, click "Invoicing Software" in "Related Downloads", and select "VAT Invoice Issuing Software (Tax UKey Version)" to download.

Unzip the installation package: After the download is complete, find the downloaded file (usually in ZIP format), right-click and select "Extract to current folder" or use decompression software (such as WinRAR, 360 compression) to decompress.

Run the installer: After decompression, find the "Installer" in the decompressed folder and double-click "Run Installation" or "setup.exe" to start the installation.

Follow the prompts to install: In the installation wizard, click "Next" or "Install Now" and follow the prompts to complete the installation process. After the installation is complete, a shortcut to the invoicing software will be generated on the desktop.

How to upgrade VAT invoice issuing software

Automatic upgrade: Log in to the invoicing software while connected to the Internet, and the system will automatically detect whether there is a new version. If so, an upgrade prompt will pop up. Click "Confirm" or "Upgrade Now" and the system will automatically download and install the latest version.

Manual upgrade:

Download the latest version: Visit the National VAT Invoice Inspection Platform of the State Administration of Taxation or the download center on the official website of local tax bureaus to download the latest invoicing software installation package.

Install the new version: Run the downloaded installation package and follow the prompts to complete the installation. You may be prompted to back up data during the installation process. It is recommended to follow the prompts to back up data to prevent data loss.

How to clear cards in VAT invoice issuing software

Connect the tax UKey: Plug the tax UKey into the USB port of the computer.

Open the invoicing software: double-click the invoicing software shortcut on the desktop and enter the password to log in.

Enter the card clearance interface: In the invoicing software, click "Invoice Management" → "Invoice Purchase Management" → "Clear Card".

Perform the card clearing operation: On the card clearing interface, follow the system prompts. You usually need to enter the tax UKey password and other information, and then click the "Clear Card" button to complete the operation.

VAT invoice invoicing software invoicing steps

Log in to the software: Insert the tax UKey, open the invoicing software, enter the device password and user password to log in.

Invoices are distributed online:

Click "Invoice Management" → "Invoice Purchase Management" → "Invoice Online Distribution".

Query the information of undistributed and to-be-distributed invoices, select the invoice to be distributed, enter the number of distribution copies, and click "Distribute".

Fill in the invoice information:

Click "Invoice Management" → "Issuance of Positive Invoice" and select the invoice type (such as ordinary value-added tax invoice).

Fill in the buyer information, product or service information, amount, tax rate and other necessary contents on the invoicing interface.

Save and print: After completing the filling, click the "Save" button to save the invoice information, and then click the "Print" button to print the invoice.

How to use VAT invoice invoicing software to issue invoices

Log in to the invoicing software: insert the tax UKey, open the software, and enter the password to log in.

Enter the invoicing interface: click "Invoice Management" → "Issuance of positive invoices" and select the type of invoice to be issued.

Fill in the invoice content:

Buyer information: fill in the buyer’s name, taxpayer identification number, address, phone number, account opening bank and account number, etc.

Product or service information: Add the name, specification, model, unit, quantity, unit price, amount, tax rate, tax amount, etc. of the product or service.

Other information: Fill in notes and other other information as needed.

Save and print the invoice: After completing the filling, click "Save" to save the invoice information, and then click the "Print" button to print the invoice.

VAT invoice issuance software tax UKey versionFunction introduction

User login: This software is suitable for users who have obtained the tax control disk security code.

Normal invoicing: Users need to prepare paper invoices before invoicing, and check whether the invoicing computer is connected to the tax control disk,printer

Set encoding: This software supports productencoding, set codes for VAT products, and provide many basic coding settings for items

Product settings: The software supports settings for multiple types of products, including motor vehicle product settings.

Invoice editing: This software supports invoice editing. When printing, you can display the tax control disk status, view data entry information, and view invoice types.

Data input and export: The software supports manual input of data into the software, and can also be read from the tax control disk to support the export of invoice data.

Types of invoices: Support special VAT invoices, ordinary VAT invoices, support the issuance of special freight invoices, unified motor vehicle sales invoices, etc. on the software

VAT invoice issuance software tax UKey version software features

1. The software provides invoice management function, and you can view the issued invoices in the software

2. Provide detailed guidance settings and fill in the invoicing options.

3. Support identity selection, you can choose the buyer to apply for sales or the seller to apply

4. You can quickly issue VAT in the software and fill in ordinary VAT

5. It also supports changes involving sales quantity, only involvingsalesAmount change

6. Support tax UKey invoice repair, you can set the invoice type: ordinary value-added tax invoice (voucher)

7. You can set the repair method, support repair by time and repair by number segment

VAT invoice issuance software tax UKey version installation steps

1. Download the installation package of the VAT invoice invoicing software tax UKey version from Huajun Software Park. After unzipping, double-click the exe program to enter the installation interface.

2. Click Custom Installation, select the installation path, and click Install Now

3. The software is being installed, please wait patiently.

4.Software installation completed

VAT invoice issuance software tax UKey version recommended software of the same type

Piowang Jinfu tax control invoice issuance software

Piowang Jinfu tax control invoice issuance softwareThe latest version is a very popular and professional dailyFinanceProfessional financial software for managing value-added tax invoices, the latest version of Piowang Tax Control Invoice Issuing Software supports dozens of different invoice types. Users only need to fill in the data according to the invoice template provided by the official version of Piowang Jinfu Tax Control Invoice Issuing Software, and then they can directly print out the invoices for use.

Download address:http://softwaredownload4.com/soft/10002255.htm

Cloud Ticket Assistant

Cloud Ticket AssistantIt is a practical financial invoicing tool developed by Xuanji Baiwang. The computer version of Cloud Ticket Assistant is powerful and simple to operate, which can help users easily and quickly perform invoicing operations. Cloud Ticket Assistant is comprehensive in functions, including invoice issuance, inspection, collection, input and output services, smart finance and taxation, etc. Cloud Ticket Assistant supports invoicing operations for any ticket type, device, scenario, etc.

Version:

v1.0.35 official version | Update time:

2025-10-23