The official version of the Henan Provincial Electronic Taxation Bureau of the State Administration of Taxation is the tax declaration system of Henan Province. The official version of the Henan Provincial Electronic Taxation Bureau of the State Administration of Taxation provides users with self-service tax inquiry and processing services, which is convenient for users. The Henan Provincial Electronic Taxation Bureau software of the State Administration of Taxation is officially released by the Henan Provincial Branch of the State Administration of Taxation, providing taxpayers with convenient tax-related services anytime, anywhere, without leaving home.

National Taxation Bureau Henan Provincial Electronic Taxation BureauSoftware introduction

The latest version of the Henan Electronic Taxation Bureau of the State Administration of Taxation is a taxpayer-side tax-related service software launched by the Henan Electronic Taxation Bureau of the State Administration of Taxation. It mainly builds a comprehensive tax-related service platform for taxpayers that can handle tax-related matters online, check the progress of tax-related matters, and provide one-stop inquiries. It can provide taxpayers with convenient, all-round, all-weather services without regional differences, reduce tax costs, improve work efficiency, and provide taxpayers with convenient tax-related services anytime, anywhere, without leaving home.

National Taxation Bureau Henan Provincial Electronic Taxation BureauSoftware function

【I want to make an appointment】

Corresponding to the "Interactive Center - Tax Appointment", it includes three sub-modules: making an appointment, making an appointment by calling a number, and making an appointment inquiry.

【My to-do list】

Corresponding to the "Interactive Center-My Message-Taxpayer To-Do" module. Taxpayers' tax-related and declaration pending items are displayed here.

【My information】

Including: taxpayer information, electronic information, user management and synchronized registration information.

【Personalized service】

Corresponding to the "I want to do tax-Personalized tax processing" module, it includes three sub-modules: package and combination business, special business and customized business.

【Notification Announcement】

Corresponding to "Public Service - Notices and Announcements", its function is to issue tax-related notices, important reminders, announcements and other documents and information to the public and taxpayers.

【Interactive Center】

Taxpayers and tax authorities realize interconnection and online interaction. It provides functions such as tax appointment, interactive consultation, and tax evaluation.

【I want to file taxes】

Realize the handling and inquiry business of tax-related matters, declaration matters, etc.

【I want to inquire】

Including processing progress and result information inquiry, invoice information inquiry, declaration information inquiry, etc.

【Public Services】

It consists of three parts, namely notices and announcements, consultation and guidance, and public inquiries.

National Taxation Bureau Henan Provincial Electronic Taxation BureauHow to use

Enterprise login

The Electronic Taxation Bureau provides two login methods, CA and SMS, for corporate taxpayer users. When a corporate taxpayer user clicks "My To-Do, I Want to Make an Appointment, Personalized Service, My Information, I Want to Apply for Taxes, I Want to Inquire, and Interactive Center", the system will determine the user's login status. If you are not logged in, a login window will pop up. Users are free to choose CA login or SMS login.

CA login

Enterprise users choose CA to log in, enter the enterprise taxpayer identification number or social unified credit code and the electronic tax bureau login password for verification, and at the same time verify the CA key digital certificate password.

SMS login

Business users choose to log in via SMS and enter the corporate taxpayer identification number or social unified credit code and the electronic tax bureau login password for verification. After passing the verification, select the corporate user login identity (legal person/financial person/tax handler/ticket purchaser) and mobile phone number for SMS verification code verification. After passing the verification, the login is successful.

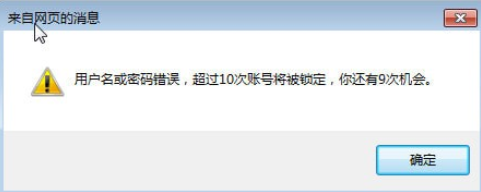

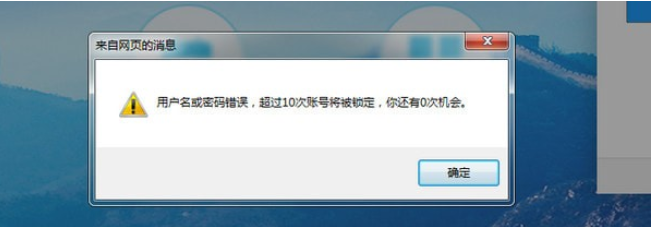

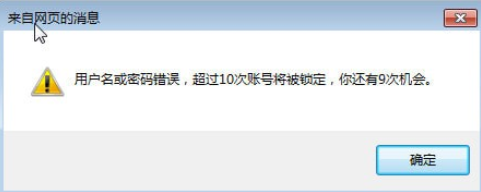

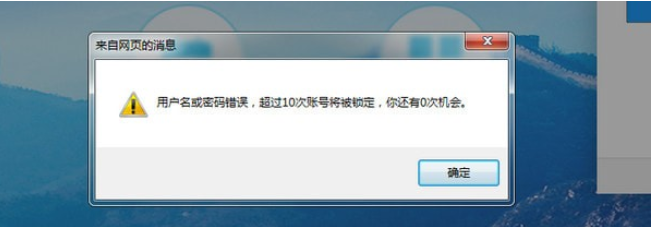

If the taxpayer identification number or password is incorrect, a prompt box will pop up: "If the user name or password is incorrect more than 10 times, the account will be locked, and you have x chances." See the picture below for details:

If the number of incorrect entries be entered more than 10 times, you need to wait for the system to be automatically unlocked on the next calendar day, or the company will contact the system operation and maintenance provider for processing.

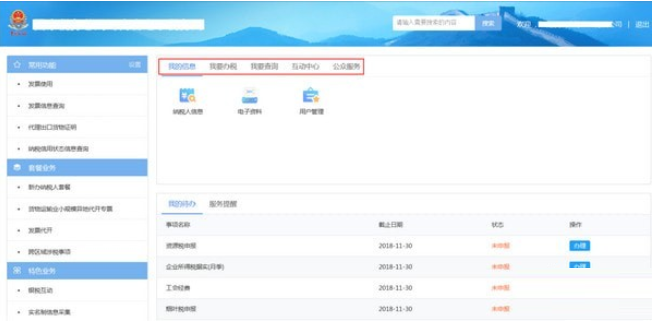

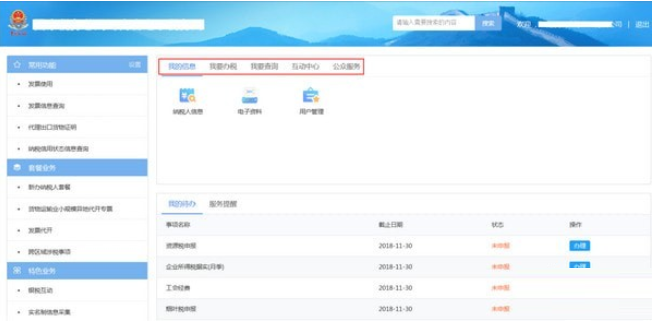

Enterprise login main interface

After logging in to the system with the corporate identity, enter the main interface of the corporate identity, which is located in the “My Information” tab interface. By switching the top tab, the interface can be switched between "My Information, I Want to File a Tax, I Want to Inquire, Interactive Center, and Public Services". As shown below.

The left side of the main interface is a folding menu, including commonly used functions, package services, special services and other functions. The home page contains two parts: "My To-Do" and "Service Reminders". Enterprises can quickly open specific functions through "menu search".

Natural person registration and login

Natural persons can jump to the natural person user registration page through the "I want to register" link under the "Personal Login" page of the login window, and truthfully fill in the registration information and verify the SMS to complete the registration. As shown below:

Natural persons can enter the username/password and SMS verification code through the "Personal Login" page of the login window, and then click Login to complete personal login. As shown below.

Main interface

自然人通过个人账号登录进入个人用户主界面,默认展示“我的信息”标签页面。 You can switch between each page by switching the five tabs "My Information, I Want to File a Tax, I Want to Inquire, Interactive Center, and Public Services". As shown below:

Through the entrance of this interface, various operations under the identity of a natural person can be performed. In particular, you can use "Switch Enterprise" to switch to the main enterprise identity interface of the enterprise with its tax identity.

For specific usage methods, please see the help option in the upper right corner of the software.

State Administration of Taxation Henan Province Electronic Taxation Bureau Update Log

1: Brand new interface, refreshing, simple and efficient

2: Performance is getting better and better

Huajun editor recommends:

The Henan Provincial Electronic Taxation Bureau of the State Administration of Taxation is very simple to install, has powerful functions, and has no installation garbage. It is specially recommended to everyone. Everyone is welcome to download it! This site also has Yujia Accounting, Huishuan Accounting Financial and Taxation Assistant, and Cloud Machine Manager for you to download!