Hot search terms: 360 Security Guard Office365 360 browser WPS Office iQiyi Huawei Cloud Market Tencent Cloud Store

Hot search terms: 360 Security Guard Office365 360 browser WPS Office iQiyi Huawei Cloud Market Tencent Cloud Store

financial management Storage size: 81.14 MB Time: 2022-10-21

Software introduction: The official version of the Personal Income Tax APP is an official tax management and personal tax declaration system mobile application launched by the State Administration of Taxation. Starting from 2019, all...

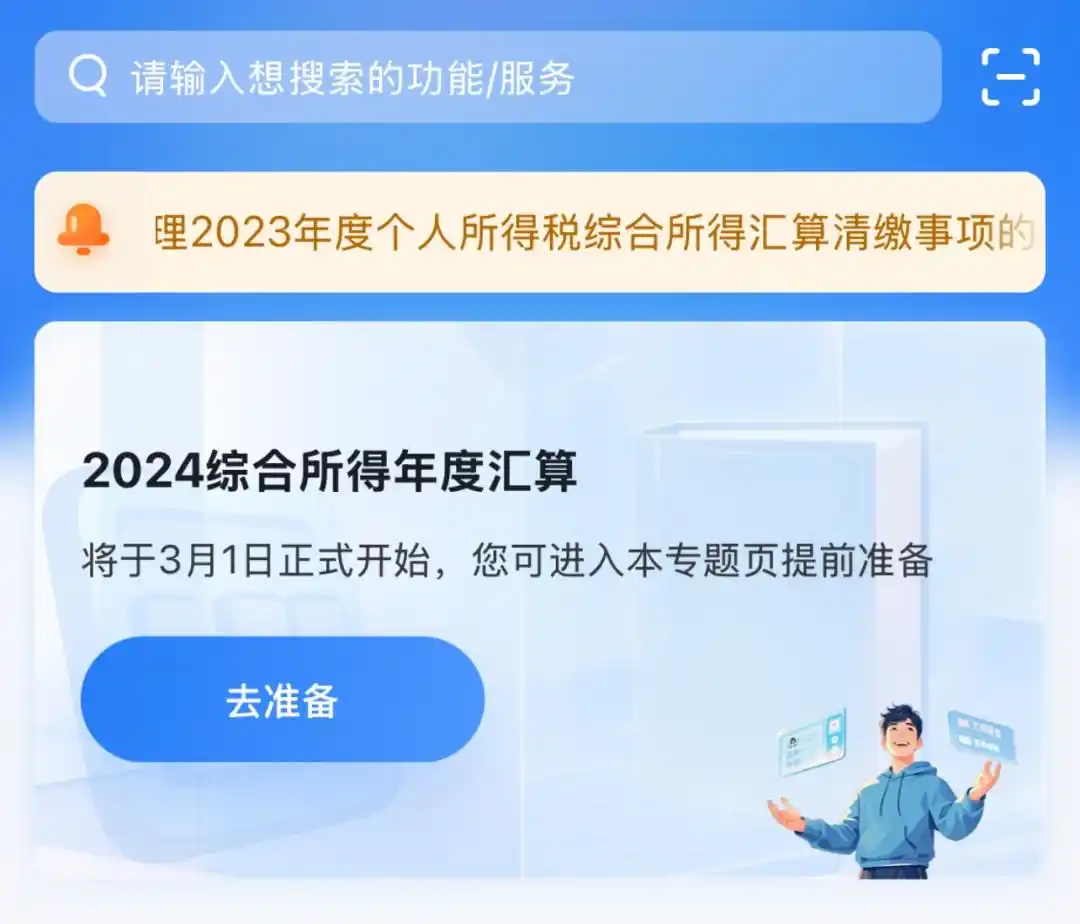

Starting from March 1, 2025, the personal income tax settlement and settlement work for 2024 has officially begun, and many people will have the opportunity to receive tax refund "red envelopes"! Don’t forget, you can start making reservations on March 21st!

What is the annual calculation of personal income tax?

Annual settlement refers to the process in which taxpayers, after the end of the year, combine and calculate the four comprehensive incomes including wages and salaries, labor remuneration, author remuneration, and royalties earned throughout the year, determine the personal income tax payable, and declare to the tax authorities for tax refunds or tax repayments.

Comprehensive income is subject to excess progressive tax rates ranging from 3% to 45%.

When can I apply?

The processing period is from March 1 to June 30, 2025, for a period of four months, and services are provided 24 hours a day, so taxpayers do not need to focus on the initial processing.

If you need to handle annual settlement from March 1 to March 20, taxpayers can make an appointment through the mobile personal income tax App from 6:00 to 22:00 every day from February 21 to March 20.

During the period from March 21st to June 30th, no appointment is required. It is recommended to proceed according to the time period notified by the unit.

Who needs to complete annual accounting?

Taxpayers who meet any of the following circumstances need to handle annual settlement:

1. The amount of prepaid tax exceeds the annual final tax payable and a tax refund is applied for;

2. The comprehensive income obtained during the tax year exceeds 120,000 yuan, and the amount of back tax required exceeds 400 yuan.

There is no need to handle annual settlement in the following situations:

Taxpayers have prepaid personal income tax in accordance with the law and meet any of the following conditions:

1. The annual settlement requires tax payment, but the comprehensive income does not exceed 120,000 yuan for the whole year;

2. The amount of tax payable in the annual settlement does not exceed 400 yuan;

3. The amount of prepaid tax is consistent with the annual final tax payable;

4. Those who meet the conditions for annual tax refund but do not apply for tax refund.

How to declare?

You can declare by downloading the "Personal Income Tax" App or logging in to the Natural Person Electronic Taxation Bureau webpage;

Central declaration can also be made by your withholding agent;

Taxpayers can entrust third-party intermediaries or individuals to handle annual settlements on their behalf;

Mail the required materials to the designated tax authorities for declaration as required;

Or go to the tax service office of your local competent tax authority to make an on-site declaration.

How to do it? (Take the personal income tax APP as an example)

Verify information

Reservation steps

receive this information

Don't trust it gullibly

Scam 1: “You have a tax refund waiting to be claimed”

The xx Taxation Bureau of the State Administration of Taxation reminds: The 2024 comprehensive income tax settlement and declaration work has begun. The tax system shows that you have a tax refund of xxx yuan. Please log in to the following designated website of the tax bureau (www.xxx.com) and follow the prompts to handle it. Overdue processing will not be processed. Fake!

Scam 2: “Professionals can help you get more tax refunds”

As long as you provide your personal tax App account password and bank card number, we can help you handle the personal tax settlement and refund. We will pay the service fee in proportion to the tax refund amount. If it fails, no fee will be charged! Fake!

Scam Three: Inducing to fill in false personal tax information

On the grounds of "taking advantage of preferential tax policies" and "reducing personal burdens", they claim that they can use false qualifications, names, etc. to provide relevant personal tax refund "services" and increase the amount of tax refunds. Fake!

Scam 4: Tax inspectors contact you

The "tax audit department personnel" will notify you by calling or sending a text message that you have been included in the list of this tax audit. Next, "notifications" and "information" will be sent through chat software to request transfer to the designated account. Fake!

Scam 5: Provide “manual tax refund”

"Tax bureau staff" informed by phone that the "manual tax refund green channel" can be used to speed up the payment. Personal information such as ID card and bank card account number is required for identity verification. Fake!

Internet police reminder:

Do not provide any of your account numbers and passwords to strangers.

The tax inspection department will have strict regulations and procedures when conducting random inspections, and will not notify taxpayers to provide relevant information through SMS, QQ, WeChat and other channels.

When you receive a call from a so-called "manual tax refund", be vigilant and do not believe the so-called "manual tax refund".

Always remember not to click on links to unfamiliar websites. For matters related to tax refunds, please handle relevant business directly on the official “Personal Income Tax” App of the State Administration of Taxation. If you encounter such an incident, please check with the tax department for verification and handling in a timely manner.

Source: cctv.com

How to check the major in the Sunshine College Entrance Examination? -Methods for checking majors in Sunshine College Entrance Examination

How to check the major in the Sunshine College Entrance Examination? -Methods for checking majors in Sunshine College Entrance Examination

How to set up Anjuke Mobile Broker to allow brokers to say hello? -Anjuke mobile broker sets a method to allow brokers to say hello

How to set up Anjuke Mobile Broker to allow brokers to say hello? -Anjuke mobile broker sets a method to allow brokers to say hello

How can Anjuke Mobile Broker turn off allowing brokers to say hello? - Anjuke mobile broker closes the method that allows brokers to say hello

How can Anjuke Mobile Broker turn off allowing brokers to say hello? - Anjuke mobile broker closes the method that allows brokers to say hello

How to find an agent in Anjuke Mobile Agent? -How to find a broker through Anjuke Mobile Broker

How to find an agent in Anjuke Mobile Agent? -How to find a broker through Anjuke Mobile Broker

How to report an Anjuke mobile agent? -How to report an agent on Anjuke Mobile Broker

How to report an Anjuke mobile agent? -How to report an agent on Anjuke Mobile Broker

Double speed classroom computer version

Double speed classroom computer version

KuGou Music

KuGou Music

little red book

little red book

Seven Cats Free Novel

Seven Cats Free Novel

learning pass

learning pass

tomato free novel

tomato free novel

Tencent App Store

Tencent App Store

QQ HD

QQ HD

and family relatives

and family relatives

How to use Fliggy’s student discount? List of student certification methods on Fliggy

How to use Fliggy’s student discount? List of student certification methods on Fliggy

How to find the help center for Panzhi Sales - How to find the help center for Panzhi Sales

How to find the help center for Panzhi Sales - How to find the help center for Panzhi Sales

How to change ID card with taptap-How to change ID card with taptap

How to change ID card with taptap-How to change ID card with taptap

How to add friends on steam mobile version - How to add friends on steam mobile version

How to add friends on steam mobile version - How to add friends on steam mobile version

How to Chineseize ourplay with one click - How to Chineseize ourplay with one click

How to Chineseize ourplay with one click - How to Chineseize ourplay with one click