Tips for using corporate income tax quarterly returns

Tips for using corporate income tax quarterly returns

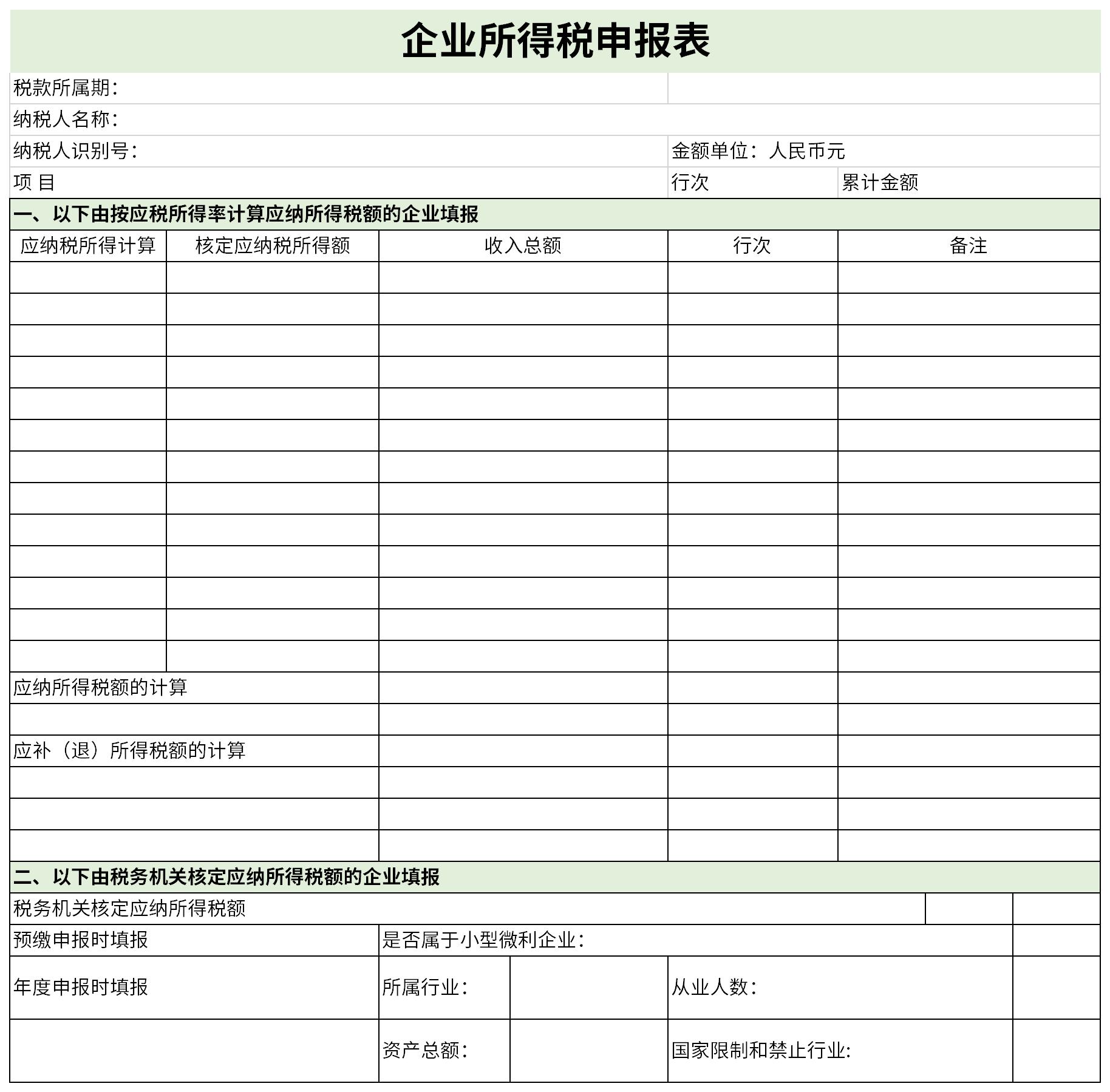

Corporate Income Tax Quarterly ReturnHow to fill it out?

1. Copy of business license, (national and local tax) tax registration certificate, organization code certificate, and copy of foreign exchange registration certificate (stamped)

2. This year’s balance sheet, income statement, and cash flow statement (stamped)

3. Last year’s audit report, last year’s income tax settlement and settlement assurance report

4. Copies of local tax comprehensive return form and value-added tax return form (stamped)

5. Electronic receipt of all taxes in January (stamped)

6. Copy of corporate income tax quarterly prepayment return (stamped)

7. General ledger, subsidiary ledger, and accounting vouchers

8. Cash count sheet, bank statement and balance reconciliation sheet (stamped)

9. Fixed assets inventory list, fixed assets and depreciation accrual details (stamped)

10. Copies of tax authority documents and relevant supporting documents entitled to preferential policies

2. Use the year and month of birth to calculate the age formula: =TRUNC((DAYS360(H6, "2009/8/30", FALSE))/360,0).

3. Calculation formula from the birth year and month of the entered 18-digit ID number:

=CONCATENATE(MID(E2,7,4),"/",MID(E2,11,2),"/",MID(E2,13,2)).

4. To let the system automatically extract the gender from the entered ID number, you can enter the following formula:

=IF(LEN(C2)=15, IF(MOD(MID(C2,15,1),2)+1."Male","Female), IF(MOD(MID(C2,17, 1),2 )=1,"Male","Female")) "C2" in the formula represents the cell where the ID number is entered.Recommended by the editor of Huajun Software Park

Corporate Income Tax Quarterly ReturnIt is a very practical form, and most of the forms to be filled in are for general purposes. If you happen to need to download the quarterly corporate income tax return, please download it quickly. also,Excellent employee evaluation form,Company annual meeting expense budget tableIt is also a good form template. You are welcome to click to download and experience it.

it works

it works

it works