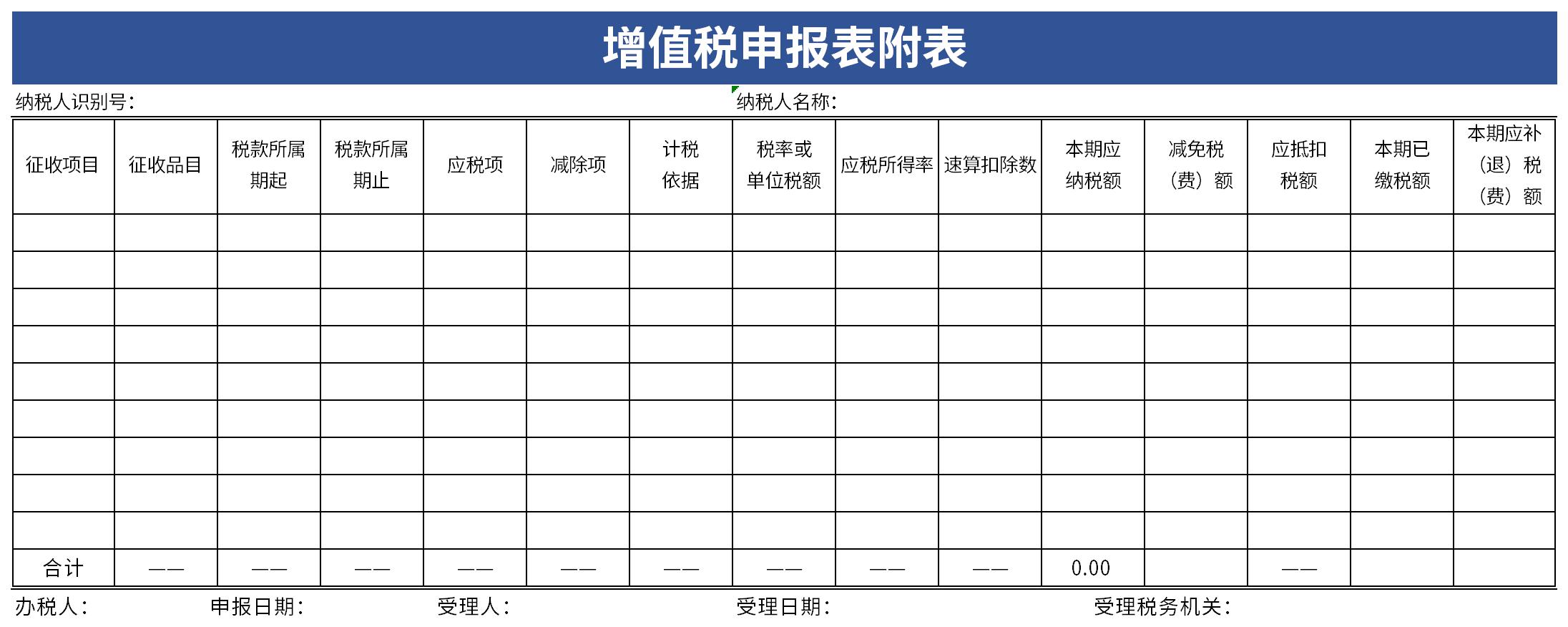

Tips for using Schedule 1 of VAT return

Tips for using Schedule 1 of VAT return

VAT is levied as follows:

General taxpayer

(1) Taxpayers who produce goods or provide taxable services, and taxpayers who mainly produce goods or provide taxable services and also engage in the wholesale or retail of goods, whose annual taxable sales exceed xx million;

(2) Engaged in the wholesale or retail business of goods, with annual taxable sales exceeding xx million yuan.

First, select the cells you want to check or cross, and select the font as Wingdings 2 in the Home tab.

Then enter R in the cell to make a check, and S to make a cross.

Automatically extract birthday

You only need to enter =TEXT(MID(H6,7,8),"0000-00-00") in the birthday cell and press Enter. *H6 is the cell where the ID number is locatedRecommended by the editor of Huajun Software Park

Schedule 1 of VAT ReturnIt is a very practical form, and most of the forms to be filled in are for general purposes. If you happen to need to download Schedule 1 of the VAT return, please download it quickly. also,business transaction report,Business performance comparison analysis tableIt is also a good form template. You are welcome to click to download and experience it.

it works

it works

it works