Tips for using small-scale VAT returns

Tips for using small-scale VAT returns

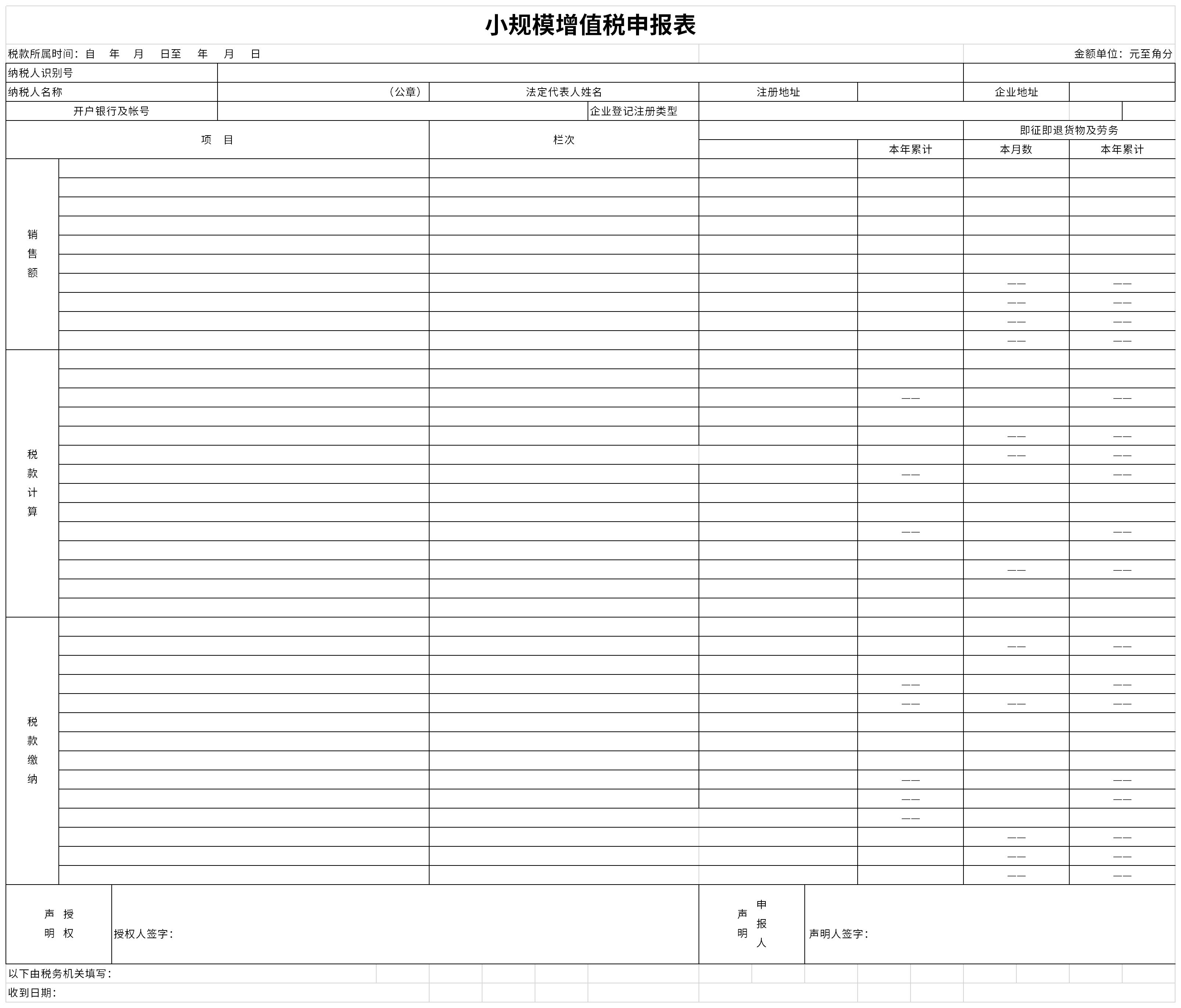

Small-scale VAT returnHow to fill it out?

1. Tax return form and its accompanying information

(1) The VAT general taxpayer tax return and its accompanying information include:

(A) "VAT Return";

(B) "Appendix Information to the Value-Added Tax Return (1)";

(C) "Appendix Information to the Value-Added Tax Return (2)";

(D) "Appendix Information to the Value-Added Tax Return (3)";

If you want to directly know the sum or average of certain numbers, just select those numbers and you will know. After selection, summation, average, and count will be displayed in the bottom status bar.

2: Format brush

The use of Format Painter is very simple. Just click on Format Painter, then select the format you want to copy, and finally select the cells you want to modify. You can modify it in batches.

3: Quick copy and paste

Select one or some data, and then move the cursor to the lower right corner of the selection box. When the cursor turns into a plus sign, drag it downwards, and it will intelligently fill in 1, 2, 3... for you.

4: Automatic line wrapping

After typing the text in the cell, find the "Automatically wrap" button on the toolbar and you can freely switch the text between wrapping and not wrapping.Recommended by the editor of Huajun Software Park

Small scale VAT returnIt is a very practical form, and most of the forms to be filled in are for general purposes. If you happen to need to download a small-scale VAT return, download it quickly. also,Administrative fees and other income collection schedule,Main business production and sales budget tableIt is also a good form template. You are welcome to click to download and experience it.

it works

it works

it works