The Chongqing Electronic Taxation Bureau platform control package is an online tax filing control program for the 12366 Electronic Taxation Bureau of the Chongqing Municipal State Taxation Bureau and the Electronic Taxation Bureau of the Chongqing Local Taxation Bureau. It is encrypted and uploaded to the tax bureau server, and can query the tax declaration result information of the enterprise. It is a tax filing security control created by the Chongqing Local Taxation Bureau for local residents of Chongqing.

Chongqing Local Taxation Electronic Taxation Bureau Tax Processing Guide

☆Instructions for registration of natural persons

1. Front desk registration: Download and fill out the registration credit form (applicable to natural persons) from the Chongqing Local Taxation Bureau Electronic Taxation Bureau website, bring the original personal ID card to the tax bureau for registration.

2. Online registration: Natural persons register by themselves through the electronic tax bureau (will be opened later).

☆Instructions for registration of unit taxpayers

1. Download and fill out the registration credit form from the Chongqing Local Taxation Bureau Electronic Taxation Bureau website (applicable to corporate taxpayers and individual industrial and commercial households), fill in the registration credit form and stamp it with the official seal.

2. An organizational user needs a contact person when registering. The contact person has the authority to manage the contact enterprise. The contact person should register as a natural person before the unit is granted credit.

3. Unit taxpayers can only register at the front desk. The handling personnel will bring the above-mentioned registration form, a copy of the tax registration certificate or a three-in-one business license, the original ID card, and a copy of the contact person’s ID card to the competent tax authority for registration.

1. Open the electronic tax bureau

Log in to the Electronic Taxation Bureau website of Chongqing Local Taxation Bureau: HTTP://DZSWJ.CQ-L-TAX.GOV.CN

Click "Registration Credit Form Download" at the bottom right of the download page (Figure 3) to fill in the personal and company registration credit forms. The unit registration form must be stamped with the official seal. The handler will bring the information to the competent tax authority to open the electronic tax bureau.

2. Log in to the Electronic Taxation Bureau

1. Please use the IE browser that comes with Windows to log in to the Electronic Taxation Bureau. Please do not use other browsers.

2. Log in to the Electronic Taxation Bureau, click "Online Tax Filing Control Program" in Download (Figure 3), and install the download program. Failure to install the control will affect the use of the Electronic Taxation Bureau.

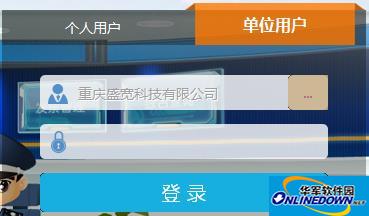

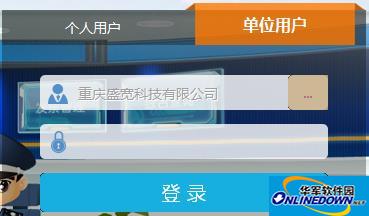

3. Select "Individual User" or "Organization User" according to the user type.

(1) Individual users enter their username and password. If dynamic verification is enabled, they need to obtain a verification code to log in.

(2) The unit user inserts the CA certificate and enters the password to log in.

3. Click "Login" to enter the electronic tax bureau operation interface.

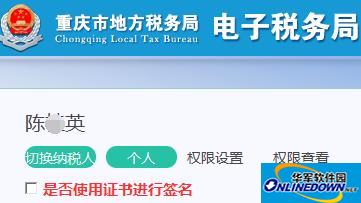

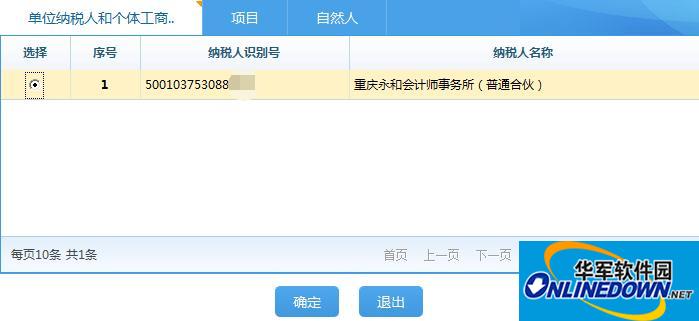

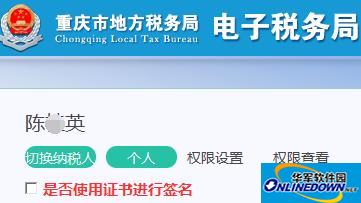

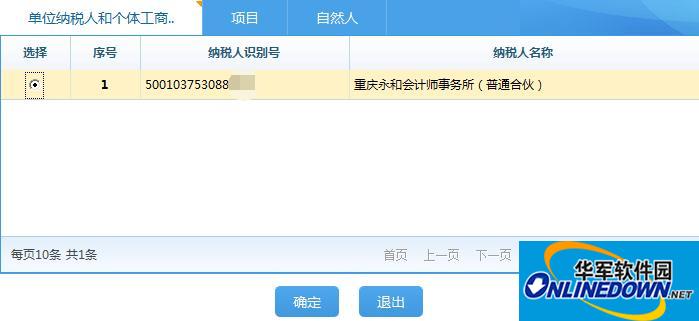

3. Switching of taxpayers

Individual users can directly enter the electronic tax bureau operation interface for contacting enterprises, projects or individuals by switching taxpayers.

Click "Switch Taxpayer", select the contact company, project or personal information, and click OK to switch the operation interface.

4. Password changes and forgotten passwords

1. To change the personal user password, click the downward triangle in the upper right corner of the interface to select Change Password, and enter the original password and new password.

2. To retrieve the personal user password, click the "Forgot Password" button under the login page to enter the self-service password retrieval interface.

3. Modify the organization user password, insert the CA certificate, and click the desktop icon Enter the CA management interface, click PIN code management to enter the initial password and information password.

Enter the CA management interface, click PIN code management to enter the initial password and information password.

4. To retrieve the organizational user password, currently you can only go to the tax authorities to retrieve it.

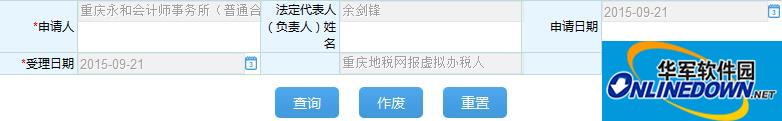

5. Tax declaration

Click "Tax Declaration" to select the declaration form type to enter the declaration interface.

Enter the declaration data, check that the declaration data is correct, and click the "Save" button. If there is any tax, it can be transferred to the tax deduction process.

If you need to void the return form, you can click "Tax Declaration" to select the void form. Query the application information based on conditions such as the application date or period, select the corresponding entry, fill in the reason for invalidating the application, and click Cancel.

6. Payment of taxes (fees)

Click "Pay Tax" to enter the "Tax Deduction" or "Deduction" interface.

Check the deduction information and select the payment method. To pay taxes (fees) with a UnionPay card, you can use any UnionPay bank card to pay directly without opening online banking.

If the tax deduction lock requires the electronic tax invoice number to be invalidated, it can be used to invalidate the tax payment voucher module on the bank side.

7. View tax-related information

Click "My tax-related information" and select View information to enter the display interface.

8. Declaration of personal income tax withholding and payment details

Click "Withholding and Payment" - "Declaration of Personal Income Tax Withholding and Payment Details" to enter the declaration interface.

9. Inquiry and printing of personal income tax payment certificate

1. The withholding agent can click "My Tax Information" - "Personal Income Tax Payment Certificate Inquiry and Print" to issue a "Personal Income Tax Payment Certificate" for individual employees.

2. Natural persons can issue their own "Personal Income Tax Payment Certificate" by clicking "My Tax Information" - "Personal Income Tax Payment Certificate Inquiry and Printing".

10. Online help

For tax-related application, data submission and various process matters, you can press the "F1" key on each module interface to get help, or download the "Online Tax Help Manual" (Figure 3) to view.

11. Mobile taxation

(1) WeChat public account of the Electronic Taxation Bureau

1. Open WeChat, scan the QR code below or search for "Chongqing Local Taxation", and follow the Chongqing Local Taxation WeChat official account.

2. Enter the Chongqing Local Taxation Official Account, click the "Electronic Taxation Bureau" menu, click "Bind WeChat", enter the natural person Electronic Taxation Bureau registration username and password, and bind the WeChat official account. Only after binding WeChat can you use the Electronic Taxation Bureau related functions.

3. Log in using the user name and password registered with the Electronic Taxation Bureau for natural persons, and enter the main interface to operate related functions.

4. Public inquiries and interactions can be used without logging in.

(2) Electronic Taxation Bureau mobile APP

1. Use the QR code scanning function of your mobile phone to scan the QR code below to download and install the Electronic Taxation Bureau mobile APP (currently only the Android version is supported).

2. Click the desktop icon on your mobile phone to open the Electronic Taxation Bureau mobile APP program, enter the main interface and click "Login", enter the Electronic Taxation Bureau registered username and password to log in, and you can use functions such as notifications and announcements, tax-related information, and my messages.

3. Functions such as invoice inquiry, policies and regulations, checking tax authorities, public inquiry, taxpayer school, and helping you calculate taxes can be used without logging in.

Enter the CA management interface, click PIN code management to enter the initial password and information password.

Enter the CA management interface, click PIN code management to enter the initial password and information password.