The official version of the Zhejiang Electronic Taxation Bureau of the State Administration of Taxation is an efficient, professional and practical financial software. The official version of the Zhejiang Electronic Taxation Bureau of the State Administration of Taxation has built-in powerful functions. The software can edit declaration forms in the software, send declarations in the software, and pay fees in the software. Through this software of the Electronic Taxation Bureau of the State Administration of Taxation in Zhejiang Province, you can perform tax payments without going to the tax bureau to handle business. It is very convenient and practical.

State Administration of Taxation Zhejiang Electronic Taxation BureauSoftware function

Registration of suspension of business

已设企业,定期定额征收方式的个体工商户,在停止生产经营前,在停业前可在此模块办理停业登记。

Registration for resumption of business

Taxpayers who have registered for business suspension shall apply to the competent tax authorities for resumption of business registration before resuming production and operations.

Confirmation of household registration information with one photo and one code

When newly registered enterprises and farmer cooperatives handle tax-related matters for the first time, the tax authorities will prepare the "One Photo, One Code Household Registration Information Confirmation Form" based on the registration information shared by the industrial and commercial departments, reminding taxpayers to supplement the incomplete information, correct the inaccurate information, and supplement and correct the information that needs to be updated.

The two certificates are integrated to confirm the registration information of individual industrial and commercial households

Taxpayers can use this function to verify and confirm the relevant registration information of individual industrial and commercial households integrated with the two certificates.

Deposit Account Account Report

After receiving the tax registration certificate, those engaged in production and business operations must report to the tax authorities all deposit accounts opened in banks or other financial institutions within 15 days from the date of opening a basic deposit account or other deposit accounts. If a change occurs, a written report must be made in this module within 15 days from the date of change.

Financial accounting system filing

After receiving the business license, taxpayers shall submit their financial and accounting systems or financial and accounting treatment methods to the competent tax authorities for filing.

Social insurance premium payer deposit account account report

Taxpayers engaged in production and business operations shall report to the tax authorities all deposit accounts they have opened in banks or other financial institutions.

Abnormal account cancellation

Taxpayers who have gone through tax registration failed to declare taxes within the prescribed time limit, and after the tax authorities ordered them to make corrections within a time limit, they failed to make corrections within the time limit, and the tax authorities sent personnel for on-site inspections and found that their whereabouts were not found and the taxpayers could not be forced to perform their tax obligations.

Registration of tax withholding

Units and individuals that have the obligation to withhold taxes in accordance with tax laws and administrative regulations shall apply for tax withholding registration with the tax authorities in the place of production and operation.

Cross-regional tax-related matters reporting

Use this functional module to handle reports on temporary production and business activities across provinces (autonomous regions, municipalities directly under the Central Government and cities under separate state planning).

Cancellation of tax registration

Units and individual industrial and commercial households are disbanded,

If the tax (fee) obligation is terminated in accordance with the law due to cancellation or other circumstances, the person shall apply to the tax authorities for cancellation of social insurance payment information registration before applying for cancellation of social insurance registration to the social insurance institution; before applying for cancellation of registration to the industrial and commercial administration authority or other authorities, the applicant shall apply to the tax registration authority for cancellation of tax registration.

Real-name collection

Real-name collection refers to the reporting of natural attribute information that taxpayers and withholding agents have had since their establishment, such as taxpayer name, registration number, etc.

Register type, registered address, production and operation address, head office and branch office, investor information, etc.

State Administration of Taxation Zhejiang Electronic Taxation BureauSoftware features

1. The Zhejiang Electronic Taxation Bureau of the State Administration of Taxation facilitates tax payment and is targeted at enterprise development

2. It can improve the efficiency of corporate taxation and quickly add corporate financial data to the software

3. Most data can be imported directly from Excel, making it easier to import financial data next time

4. It is also very convenient to declare turnover. You can declare it quarterly or annually.

5. There are many declaration items. Click on a mode to display the tax return form immediately.

6. Support financial statements 2013 (Accounting Standards for Small Businesses) and VAT general taxpayer declarations

7. It also supports urban construction tax, education surcharge, and local education surtax (fee) declaration form

8. It also supports declaration invalidation, corrected declaration, pre-declaration, vehicle and vessel tax withholding and payment, tax payment, and tax source information collection.

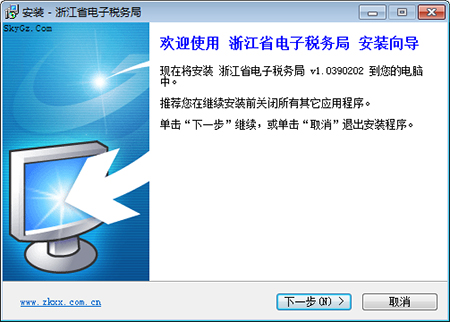

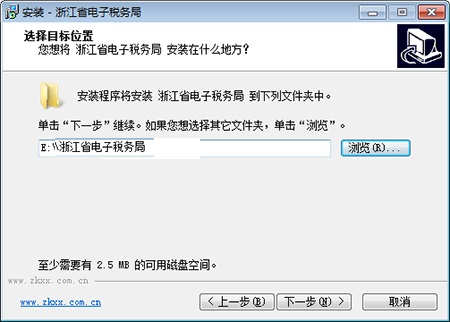

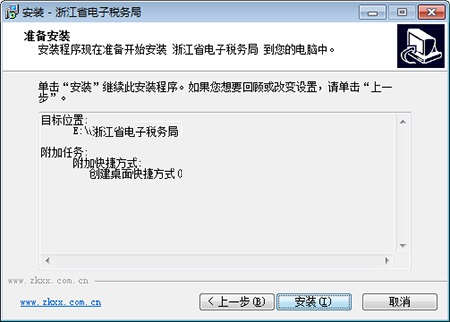

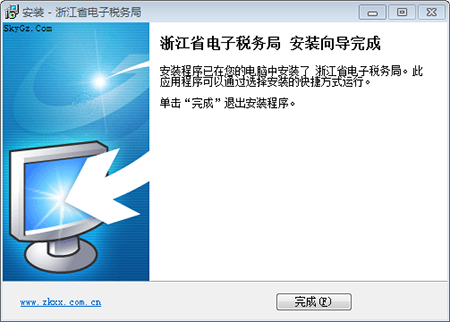

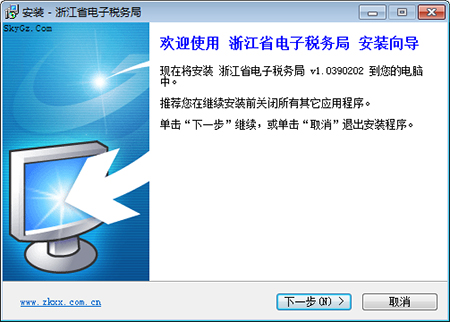

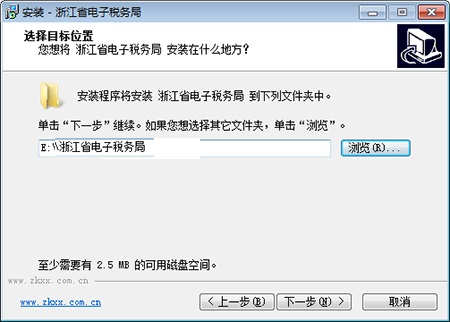

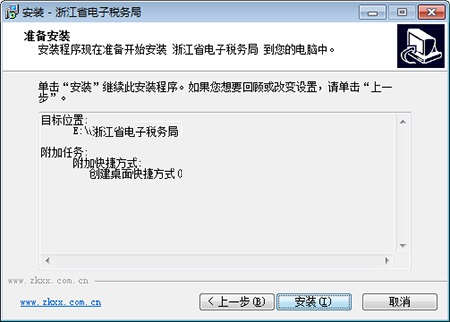

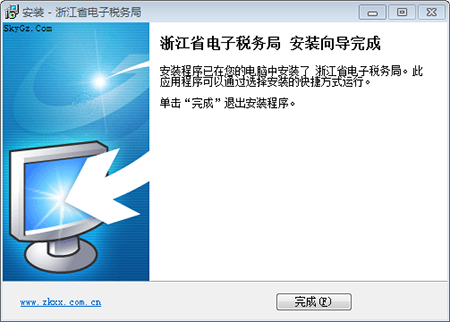

State Administration of Taxation Zhejiang Electronic Taxation BureauInstallation steps

1. Download the State Administration of Taxation Zhejiang Electronic Taxation Bureau software package from this site, unzip it and enter the installation wizard, click [Next]

2. Select the target location, click [Browse] to customize the installation file location, and click [Next] to continue.

3. Prepare to install. After confirming everything is correct, click [Install]

4. The Zhejiang Electronic Taxation Bureau of the State Administration of Taxation was successfully installed

State Administration of Taxation Zhejiang Electronic Taxation BureauHow to use

Registration of suspension of business

1. Function description

已设企业,定期定额征收方式的个体工商户,在停止生产经营前,在停业前可在此模块办理停业登记。

2. Operation path

【I want to file taxes】→【Comprehensive Information Report】→【Status Information Report】→【Closure Registration】

3. Preconditions:

(1) Have logged in to the Zhejiang Electronic Taxation Bureau normally;

(2) The taxpayer’s status must be a normal household to handle this business;

(3) The taxpayer’s registration type must be “self-employed” or “private proprietorship”;

(4) Whether the taxpayer's application for suspension of business is within the quota implementation period and the continuous suspension of business does not exceed one year. Applications that exceed the quota implementation period or exceed the suspension period will not be processed;

(5) It is necessary to settle the tax payable, late payment fees and fines, inspect the old invoices and collect the tax registration certificate and copies and uninspected and unused invoices;

(6) Taxpayers must ensure that the balance in their debit account is sufficient before applying for business suspension.

4. Operation steps

(1) Step 1: Main interface

(2) Step 2: Fill in the information

The taxpayer's basic information system will automatically obtain and assign values, and taxpayers are not required to fill in the information. Taxpayers only need to fill in the information in the "from the time of closure" and "from the time of closure" based on the taxpayer's actual situation, select "contact information", and upload the attached information.

(3) Step 3: Submit

After confirming that it is correct, click the [Submit] button, and the system will pop up a confirmation window "The person in charge is me, and this business is genuine. I (the company) is willing to bear all legal responsibilities arising therefrom."

(4) Step 4: Submission successful

Click "Confirm", it will prompt that the operation is successful, and the detailed information of filling in the form will be displayed.

(5) Step 5: Check the progress

You can check the acceptance progress of submitted tax matters through the [I want to query] - [Tax Processing Progress] module.

△ The processing status is [Applied]:

It means that the tax authority has not accepted the application yet. Taxpayers can perform operations such as [View] and [Void]. [View] can display the detailed information of the application form, and [Void] can cancel the document application;

△ The processing status is [Completed]:

It means that the tax authority has accepted and processed the taxpayer's application information, imported it into the Jinsan system for taxpayers, and printed a tax matter notice.

State Administration of Taxation Zhejiang Electronic Taxation BureauFAQ

How to apply for tax credit supplementary assessment?

1. Function description

If a taxpayer is relieved of the situation listed in the "Tax Credit Management Measures (Trial)" and other relevant regulations, or has objections to the lack of evaluation in the current period, he or she can fill out the "Tax Credit Supplementary Evaluation Application Form" and apply to the competent tax authority for a supplementary tax credit evaluation through this function.

2. Operation path

I want to apply for tax à tax credit à tax credit à tax credit supplementary assessment application

3. Preconditions:

(1) You have logged in to the Zhejiang Electronic Taxation Bureau normally.

4. Operation steps

(1) Step 1: Main interface

(2) Step 2: Fill in the information

The taxpayer’s basic information system will automatically fetch and assign values, and taxpayers do not need to fill them in. Taxpayers only need to confirm based on the actual situation of the enterprise and supplement the incomplete information.

(3) Step 3: Submit

After confirming that the filled-in information is correct, click Submit, and the system will pop up a confirmation window "The person in charge is me, and this business is real. I (the company) is willing to bear all legal responsibilities arising therefrom." After confirmation, the system prompts the submission result:

(4) Step 4: Check the progress

You can check the acceptance progress of submitted tax matters through the [I want to query] - [Tax Processing Progress] module.

State Administration of Taxation Zhejiang Provincial Electronic Taxation Bureau Update Log

1. Fixed other bugs;

2. Optimized software compatibility.

Huajun editor recommends:

The editor of the Zhejiang Provincial Electronic Taxation Bureau of the State Administration of Taxation personally authenticated it, and it is clear that no one can be deceived! This site also has similar software, Hanwang Attendance Management System, .NET, and Batch Butler. Welcome to click to download and experience it!