-

2011 year-end bonus calculator

2018-04-10

PC version

25kb

Simplified Chinese

Office software

Reasons for recommendation:

The latest 2011 year-end bonus calculator

Features:

(1) Provide modification suggestions for year-end bonuses and make after-tax comparisons

(2) Year-end bonuses can be processed in batches and checked in one go...

2011 year-end bonus calculator

2018-04-10

PC version

25kb

Simplified Chinese

Office software

Reasons for recommendation:

The latest 2011 year-end bonus calculator

Features:

(1) Provide modification suggestions for year-end bonuses and make after-tax comparisons

(2) Year-end bonuses can be processed in batches and checked in one go...

-

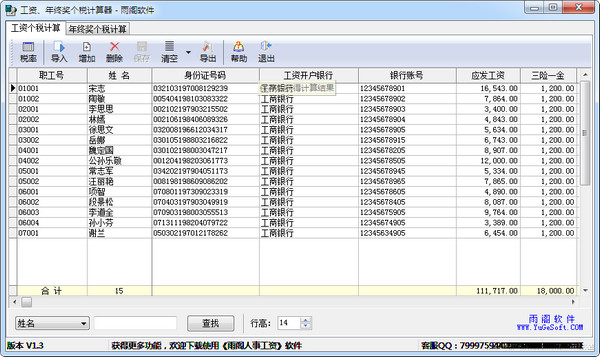

Salary year-end bonus personal tax calculator

2017-10-06

v1.3 green version

2.3M

Simplified Chinese

science tools

Reasons for recommendation:

The latest salary year-end bonus personal income tax calculator 2015, this software can help you quickly calculate salary, year-end bonus personal income tax and other related data without having to write a company...

Salary year-end bonus personal tax calculator

2017-10-06

v1.3 green version

2.3M

Simplified Chinese

science tools

Reasons for recommendation:

The latest salary year-end bonus personal income tax calculator 2015, this software can help you quickly calculate salary, year-end bonus personal income tax and other related data without having to write a company...

-

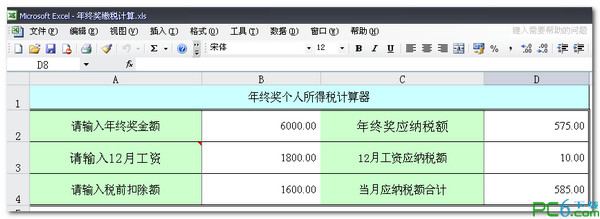

Year-end bonus tax calculation method (year-end bonus tax calculator)

2017-09-26

excel version

231KB

Simplified Chinese

financial management

Reasons for recommendation:

The calculation method for year-end bonus tax is as follows:

Individuals receiving year-end bonuses should calculate and pay personal income tax based on one month's wages and salary income separately, and follow the following procedures...

Year-end bonus tax calculation method (year-end bonus tax calculator)

2017-09-26

excel version

231KB

Simplified Chinese

financial management

Reasons for recommendation:

The calculation method for year-end bonus tax is as follows:

Individuals receiving year-end bonuses should calculate and pay personal income tax based on one month's wages and salary income separately, and follow the following procedures...

-

Salary and year-end bonus personal income tax calculator

2016-12-29

1.3

2.93MB

Simplified Chinese

commercial trade

Reasons for recommendation:

"Salary and Year-end Bonus Personal Income Tax Calculator" functions and features:

1. No need to write formulas to automatically calculate salary or year-end bonus personal income tax.

...

recommend

Salary and year-end bonus personal income tax calculator

2016-12-29

1.3

2.93MB

Simplified Chinese

commercial trade

Reasons for recommendation:

"Salary and Year-end Bonus Personal Income Tax Calculator" functions and features:

1. No need to write formulas to automatically calculate salary or year-end bonus personal income tax.

...

recommend

-

Zhu Gong’s bonus sharing saves taxes

2014-03-07

2.1.2

8.42MB

Simplified Chinese

financial management

Reasons for recommendation:

According to the "Notice of the State Administration of Taxation on Adjusting the Methods for Calculation and Collection of Personal Income Tax on Individuals Obtaining One-time Annual Bonuses, etc." (State Taxation Development [2005]...

Zhu Gong’s bonus sharing saves taxes

2014-03-07

2.1.2

8.42MB

Simplified Chinese

financial management

Reasons for recommendation:

According to the "Notice of the State Administration of Taxation on Adjusting the Methods for Calculation and Collection of Personal Income Tax on Individuals Obtaining One-time Annual Bonuses, etc." (State Taxation Development [2005]...

-

Year-end Spiritual Civilization Award Distribution Method

2013-03-23

13KB

Simplified Chinese

Human resources administration

Reasons for recommendation:

Year-end Spiritual Civilization Award Distribution Method

1. Distribution scope:

1. All current faculty, staff and retired personnel in the hospital;

2. Study for a degree while working part-time...

Year-end Spiritual Civilization Award Distribution Method

2013-03-23

13KB

Simplified Chinese

Human resources administration

Reasons for recommendation:

Year-end Spiritual Civilization Award Distribution Method

1. Distribution scope:

1. All current faculty, staff and retired personnel in the hospital;

2. Study for a degree while working part-time...

Hot search terms: 360 Security Guard Office365 360 browser WPS Office iQiyi Huawei Cloud Market Tencent Cloud Store