-

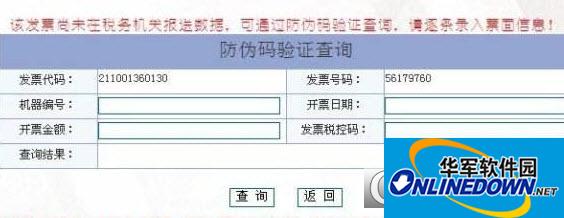

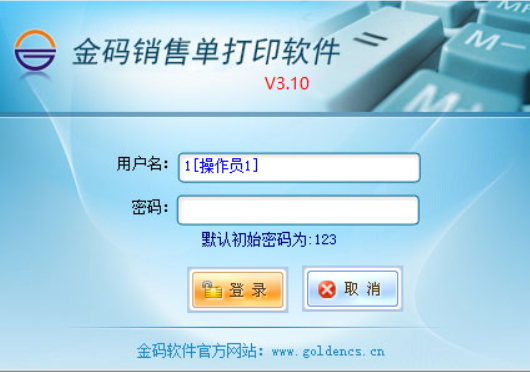

Accommodation industry VAT anti-counterfeiting tax control invoicing software Golden Tax Disk version

- Size: 13.14MBM

- Language: Simplified Chinese

- category: Printing tools

- System: WinAll

Version: Green version | Update time: 2024-11-04

Similar recommendations

Latest updates

How to log in to 360 Secure Browser? -How to log in to 360 secure browser

How to turn off footsteps in cs1.6 - How to turn off footsteps in cs1.6

How to delete robots in cs1.6-How to delete robots in cs1.6

How to buy weapons in cs1.6-How to buy weapons in cs1.6

How to install plug-in for 360 Secure Browser? -How to install plug-ins for 360 Secure Browser

How to buy bullets in cs1.6-How to buy bullets in cs1.6

How to clear the cache of 360 Secure Browser? -How to clear the cache of 360 Safe Browser

How to upgrade 360 Secure Browser? -How to upgrade the version of 360 Secure Browser

How to switch accounts to log in to iQiyi? -How to log in to iQiyi account switching account

Reviews on Golden Tax Disk Version of VAT Anti-Counterfeiting Tax Control and Invoicing Software for the Accommodation Industry

-

1st floor Huajun netizen 2022-01-08 12:09:37The VAT anti-counterfeiting tax control invoicing software for the accommodation industry, the Golden Tax Disk Edition, is very easy to use, and the download speed is fast and very convenient!

-

2nd floor Huajun netizen 2022-03-05 10:45:09The Golden Tax Disk version of the VAT anti-counterfeiting tax control invoicing software for the accommodation industry is great! 100 million likes! ! !

-

3rd floor Huajun netizen 2021-09-19 10:50:10The VAT anti-counterfeiting tax control and invoicing software for the accommodation industry, Golden Tax Disk Edition, has comprehensive functions and is quite easy to use.

Recommended products

- Diablo game tool collection

- Group purchasing software collection area

- p2p seed search artifact download-P2P seed search artifact special topic

- adobe software encyclopedia - adobe full range of software downloads - adobe software downloads

- Safe Internet Encyclopedia

- Browser PC version download-browser download collection

- Diablo 3 game collection

- Anxin Quote Software

- Which Key Wizard software is better? Key Wizard software collection