-

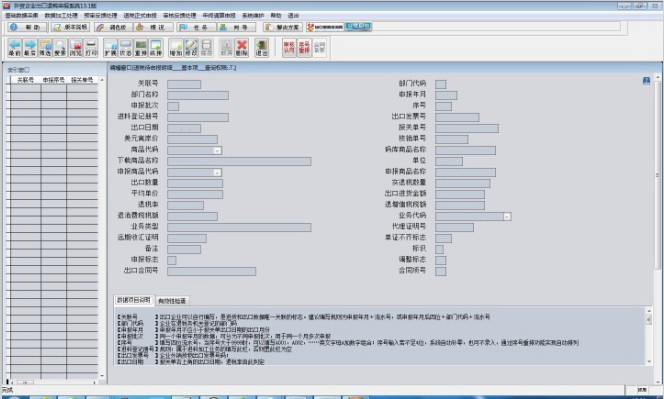

Export tax rebate declaration system for foreign trade enterprises

- Size: 57.77M

- Language: Simplified Chinese

- category: financial management

- System: Winxp/vista/win7

Version: 15.0 | Update time: 2014-07-29

Similar recommendations

Latest updates

How to turn off footsteps in cs1.6-How to turn off footsteps in cs1.6

How to delete robots in cs1.6-How to delete robots in cs1.6

How to buy weapons in cs1.6-How to buy weapons in cs1.6

How to install plug-in for 360 Secure Browser? -How to install plug-ins for 360 Secure Browser

How to buy bullets in cs1.6-How to buy bullets in cs1.6

How to clear the cache of 360 Secure Browser? -How to clear the cache of 360 Safe Browser

How to upgrade 360 Secure Browser? -How to upgrade the version of 360 Secure Browser

How to switch accounts to log in to iQiyi? -How to log in to iQiyi account switching account

Comments on export tax rebate declaration system for foreign trade enterprises

-

1st floor Huajun netizen 2020-08-16 19:58:29The export tax rebate declaration system for foreign trade enterprises is very easy to use, thank you! !

-

2nd floor Huajun netizen 2019-05-03 19:10:03The export tax rebate declaration system software for foreign trade enterprises is very easy to use, the download speed is very fast, and it is very convenient!

-

3rd floor Huajun netizen 2016-07-08 08:15:43The overall feeling of the export tax rebate declaration system for foreign trade enterprises is good and I am quite satisfied. The installation and operation are very smooth! Followed the installation step-by-step instructions and it went very smoothly!

Recommended products

-

007 cashier software management system

-

Max(TM) financial purchase, sale and inventory management system

-

Max(TM) financial purchase, sales and inventory management system Unicode

-

Kingdee Financial Software KIS Standard Edition

-

RMB amount case converter

-

Excel accounting book

-

E-tree enterprise management system (ERP software)

-

T6 enterprise management software (financial software)

-

Kingdee KIS

-

Yida member timing management system software

- Diablo game tool collection

- Group purchasing software collection area

- p2p seed search artifact download-P2P seed search artifact special topic

- adobe software encyclopedia - adobe full range of software downloads - adobe software downloads

- Safe Internet Encyclopedia

- Browser PC version download-browser download collection

- Diablo 3 game collection

- Anxin Quote Software

- Which Key Wizard software is better? Key Wizard software collection