-

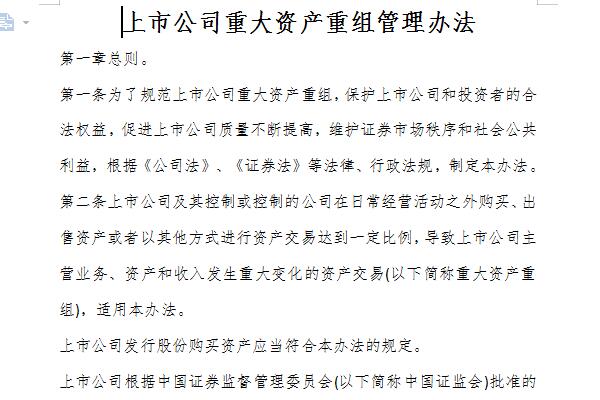

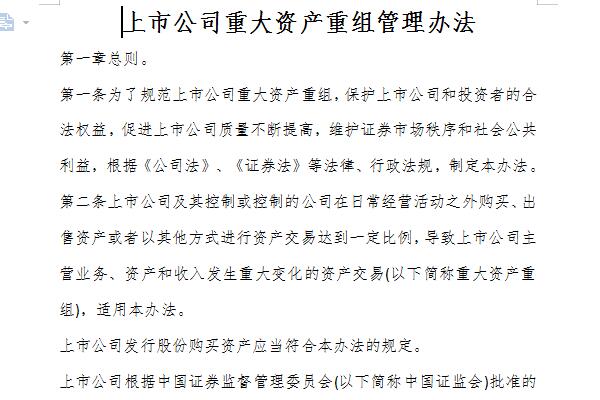

Measures for the Administration of Major Asset Restructuring of Listed Companies

- Size: 0.07M

- Language: Simplified Chinese

- category: Human resources administration

- System: winall

Version: Free version | Update time: 2024-10-31

Similar recommendations

Latest updates

How to turn off footsteps in cs1.6-How to turn off footsteps in cs1.6

How to delete robots in cs1.6-How to delete robots in cs1.6

How to buy weapons in cs1.6-How to buy weapons in cs1.6

How to install plug-in for 360 Secure Browser? -How to install plug-ins for 360 Secure Browser

How to buy bullets in cs1.6-How to buy bullets in cs1.6

How to clear the cache of 360 Secure Browser? -How to clear the cache of 360 Safe Browser

How to upgrade 360 Secure Browser? -How to upgrade the version of 360 Secure Browser

How to switch accounts to log in to iQiyi? -How to log in to iQiyi account switching account

Comments on the Administrative Measures for Major Asset Restructuring of Listed Companies

-

1st floor Huajun netizen 2021-10-10 01:42:49Very practical management method for major asset reorganization of listed companies, it is the template I need.

-

2nd floor Huajun netizen 2022-03-11 23:32:36It’s not easy to find a free template of management measures for major asset reorganization of listed companies.

-

3rd floor Huajun netizen 2021-12-21 09:55:20There is no need to pay for this template of the Management Measures for Major Asset Restructuring of Listed Companies, which is great~

Recommended products

-

Employee offer letter (offer letter)

-

Safety manager appointment letter sample

-

Administrative Measures for the Use of Fine Tickets

-

Notice of pre-approval of company name

-

Precursor chemicals management system

-

Project Department Management Rules and Regulations

-

Sample articles of articles of association of a limited company

-

resignation letter

-

Detailed rules for the selection of outstanding enterprise employees

-

Notice on further strengthening vehicle safety management

- Diablo game tool collection

- Group purchasing software collection area

- p2p seed search artifact download-P2P seed search artifact special topic

- adobe software encyclopedia - adobe full range of software downloads - adobe software downloads

- Safe Internet Encyclopedia

- Browser PC version download-browser download collection

- Diablo 3 game collection

- Anxin Quote Software

- Which Key Wizard software is better? Key Wizard software collection