Guangdong Provincial State Taxation Bureau electronic network invoice application system software functions

The left side of the interface is the commonly used menu bar, and the current company name and account number (tax number or social credit code) are displayed in the upper right and lower left corners. At the same time, there are functions such as homepage, password change, help, logout and login in the upper right corner. Note: The administrator password is taken from the online tax service hall and cannot be modified. In addition, the home page also lists the invoice name, invoicing type, single limit, approved quantity, remaining quantity and other information. Click Issuance under the operation to directly enter the invoicing interface.

Suggestion: Log in to the system and click the refresh button to update the invoice inventory information.

Reminder: When issuing an invoice, the name of the invoicer will be displayed in the lower left corner. If you want to change it, you can select the user settings in the basic information to modify the name of the login account, or double-click the invoicer's place on the issuance interface to change it directly.

Guangdong Provincial State Taxation Bureau electronic network invoice application system software features

1. The electronic (online) invoice application system of the Guangdong Provincial State Taxation Bureau provides invoice management functions

2. Invoices can be issued directly in the software

3. Support invoice type setting, select the invoice type in the software

4. Supports invoicing project settings, and can manage projects in the software

5. Support the maintenance of payer information and input the payer's information into the software

6. Support individual invoicing and corporate invoicing

7. Support the issuance of red-letter invoices and set red-letter information in the software

8. Provide invoice management, and all invoices received can be displayed on the software interface

9. Supports inventory viewing and can display all invoices that have been edited

10. Support quantity viewing function, display the remaining invoice quantity in the software

11. Support entrusted issuance, invalidation of invoices, and query of invoices

12. You can check the invoices that have been issued and the status of the invoices.

Guangdong Provincial State Taxation Bureau electronic network invoice application system installation steps

1. Download the installation package of the Guangdong Provincial State Taxation Bureau Electronic Network Invoice Application System at Huajun Software Park,UnzipAfter that, double-click the exe program to enter the installation interface.

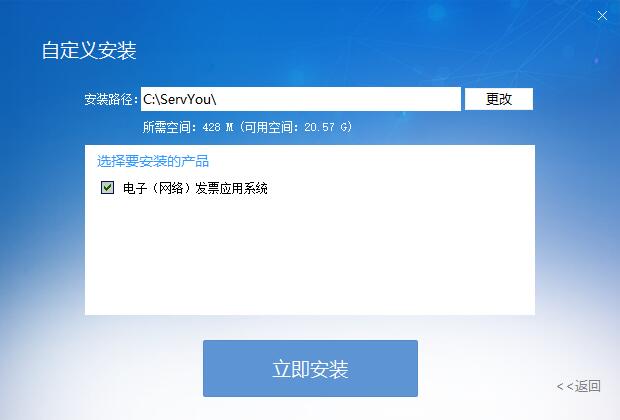

2. Click Custom Installation, select the installation path, and click Install Now

3. The software installation is complete, click to experience it now

How to use the electronic network invoice application system of the Guangdong Provincial State Taxation Bureau

Use this function to issue invoices (self-issuance). This system supports both online and offline invoicing methods. It is recommended to keep the network open when invoicing.

The system does not support the offline issuance of the Guangdong Provincial State Taxation Bureau’s universal machine-printed invoice (single-coupled flat push type) and the Guangdong Provincial State Taxation Bureau’s universal machine-printed invoice (single-coupled flat push type).

The maximum time for offline invoice issuance cannot exceed 120 hours; the amount of offline invoice issuance cannot exceed 100,000 yuan.

Select "Invoice Issuance >> Invoice Issuance", as shown below. First select the type of invoice to be issued and the invoicing items. The invoice samples corresponding to different invoice types and invoicing items are inconsistent. After checking that the face of the invoice is correct, enter the invoice information completely and click to issue.

Reminder: If the invoicing is done offline, there are words "Network abnormality, offline invoicing" on the right side of the "Reset" button in this picture.

Invoicing: The following is an example of issuing a "universal machine-type flat push invoice".

1) Enter each invoice information in turn. You can enter the name of the payer and the description of the billing item directly, or you can select it by clicking the button marked in the box below. (Reminder: The payer name and invoicing item description entered during invoicing will be automatically maintained in the payer information and invoicing item description in the basic information module. You can directly select it for the next invoicing without having to re-enter it.) Taking the selection of invoicing items as an example, click the button marked in the frame, select the required invoicing item and click [OK].

After entering the above information completely, click Issuance, and a confirmation window will pop up.

Click OK, another prompt message window will pop up, as shown below. Put the corresponding paper invoice in the printer before invoicing.

Click OK to automatically jump to the print preview interface, as shown below, click on the upper left corner to print. Reminder: You can also adjust the printing parameters in this interface. The small gear icon on the right side of the print button is the page settings. Click here to adjust the printing parameters at the bottom.

Reminder: After logging in, the default user name is 'Administrator'; if you need to modify it, you can directly click on the invoicer on the invoicing interface, and the user modification interface will pop up; after entering the real invoicer's name, the system will default to that name as the invoicer.

Frequently Asked Questions about Guangdong Provincial State Taxation Bureau Electronic Network Invoice Application System

1. Question: How to issue electronic online invoice?

Answer: Electronic network invoices can be issued through the electronic network invoice application system of the Guangdong Provincial State Taxation Bureau. First, enterprises need to register in the system and complete real-name authentication, then select the "electronic invoice" function, fill in the invoice header, taxpayer identification number and other information, upload photos of the invoice copy and stub copy, and submit the application after confirming that they are correct. The system will automatically review and generate electronic invoices, and enterprises can download or print electronic invoices.

2. Question: What is the storage and management of electronic network invoices?

Answer: Electronic network invoices can be stored and managed through the electronic network invoice application system of the Guangdong Provincial State Taxation Bureau. Enterprises can download electronic invoices in the system, or export electronic invoices to PDF and other formats for saving. At the same time, the system will back up and archive electronic invoices to ensure the security and reliability of electronic invoices.

3. Question: How to calculate the tax rate and tax amount for electronic network invoices?

Answer: The tax rate and tax amount calculation method for electronic online invoices are the same as those for paper invoices. Enterprises can perform calculations in the system based on tax rates and tax requirements for goods and services. The tax rate and tax amount information of the electronic network invoice will be automatically reflected on the invoice, making it convenient for enterprises to check and inspect.

4. Question: How to verify electronic online invoices?

Answer: Electronic online invoices can be checked through the electronic online invoice application system of the Guangdong Provincial State Taxation Bureau. Enterprises can enter invoice number, issuance date, verification code and other information into the system to check the authenticity and validity of electronic network invoices. The system will automatically compare the invoice information to verify the authenticity and legality of the electronic online invoice.

5. Question: What are the application advantages of electronic online invoices?

Answer: The application advantages of electronic network invoices mainly include: reducing the use of paper invoices, saving resources and costs; improving the efficiency of invoice issuance and management, reducing management costs; facilitating the tracing and inspection of invoice information, improving tax collection and management efficiency; promoting digital transformation of enterprises, and enhancing corporate competitiveness.

Guangdong Provincial State Taxation Bureau Electronic Network Invoice Application System Update Log

1. The pace of optimization never stops!

2. More little surprises are waiting for you to discover~

Huajun editor recommends:

After so many years of updates and optimizations, the electronic network invoice application system of the Guangdong Provincial State Taxation Bureau has become more user-friendly and more technological. It is highly recommended to everyone and welcome to download. Those who are interested can also downloadYujia Accounting,Bank of Communications Online Banking Guide,Smart Accounting and Taxation Assistant,Zhuo Zhang Financial Software,A good boss sells and sells goods.

Useful

Useful

Useful