First: Pure income is usually the object of taxation.

Second: Tax calculation is usually based on the calculated taxable income.

Third: The taxpayer and the actual bearer are usually the same, so the taxpayer's income can be directly adjusted.

1: Quick sum and average

If you want to directly know the sum or average of certain numbers, just select those numbers to find out. After selection, summation, average, and count will be displayed in the bottom status bar.

2: Format brush

The use of Format Painter is very simple. Just click on Format Painter, then select the format you want to copy, and finally select the cells you want to modify. You can modify it in batches.

3: Conditional summation

Use the SUMIF function to calculate the total score of a class:

=SUMIF(D2:D5,F2,C2:C5)

4: SUMIF usage is:

=SUMIF(condition area, specified summation condition, summation area)

In layman’s terms, it can be described as:

If the class in the D2:D5 area is equal to the "first class" of the F2 cell, sum the corresponding area of the C2:C5 cell.

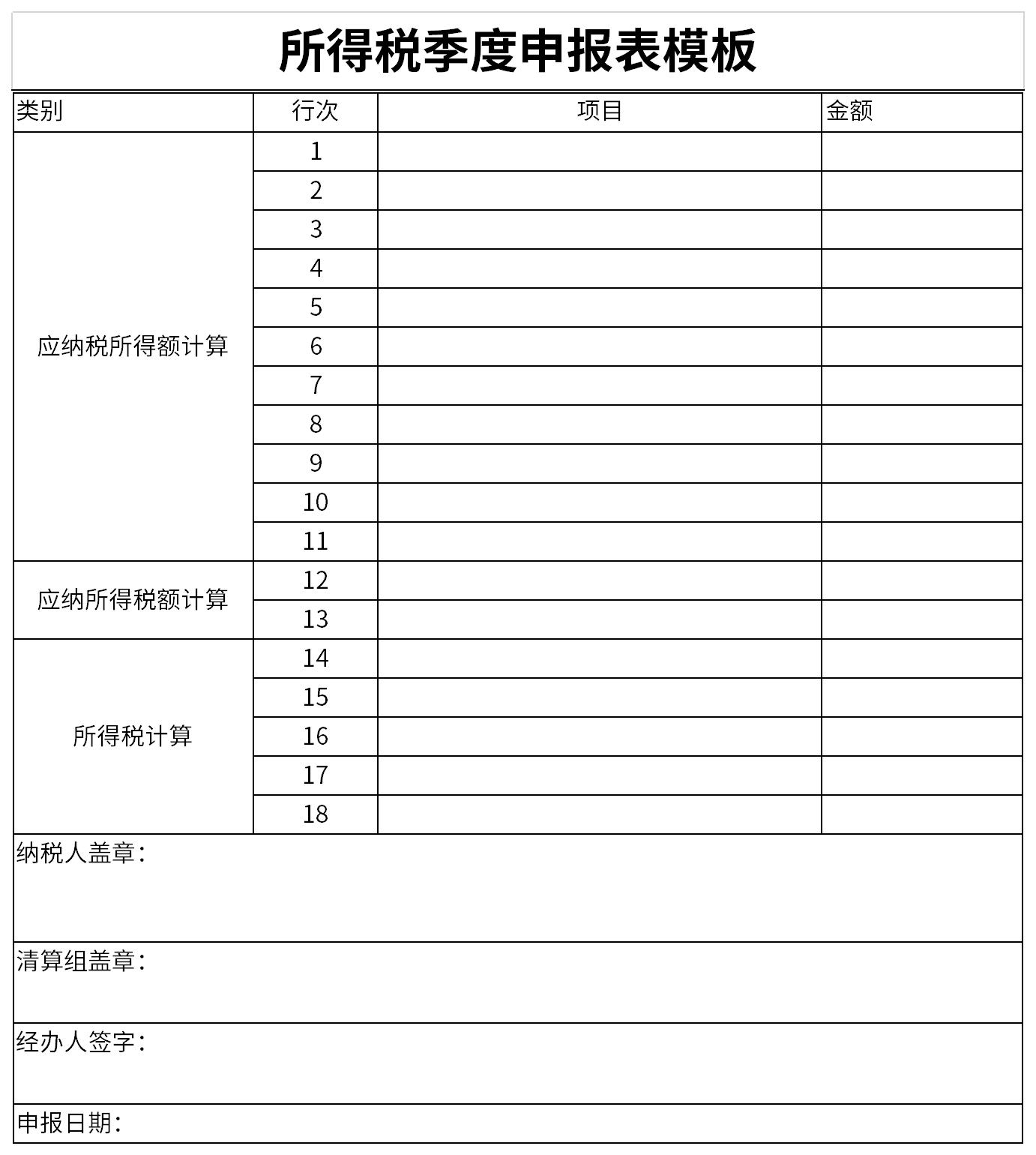

Income Tax Quarterly Return TemplateIt is a free Excel template, download it if you need it! Huajun Software Park provides high-quality Excel template downloads.System reading confirmation sheet,Office supplies registration ledgerDownload to get the source file, which you can edit, modify and replace. To download the income tax quarterly return template, go to Huajun Software Park.

Useful

Useful

Useful