First: Pure income is usually the object of taxation.

Second: Tax calculation is usually based on the calculated taxable income.

Third: The taxpayer and the actual bearer are usually the same, so the taxpayer's income can be directly adjusted.

1: Sum of multiple conditions

It is necessary to count the total amount of subsidies provided by the department for production and the position is for the main operator.

The formula is:

=SUMIFS(D2:D9,B2:B9,F2,C2:C9,G2)

2: Conditional counting

It is necessary to count the number of business transactions of the designated store. That is, count how many specified store names there are in column B.

=COUNTIF(B2:B12,E3)

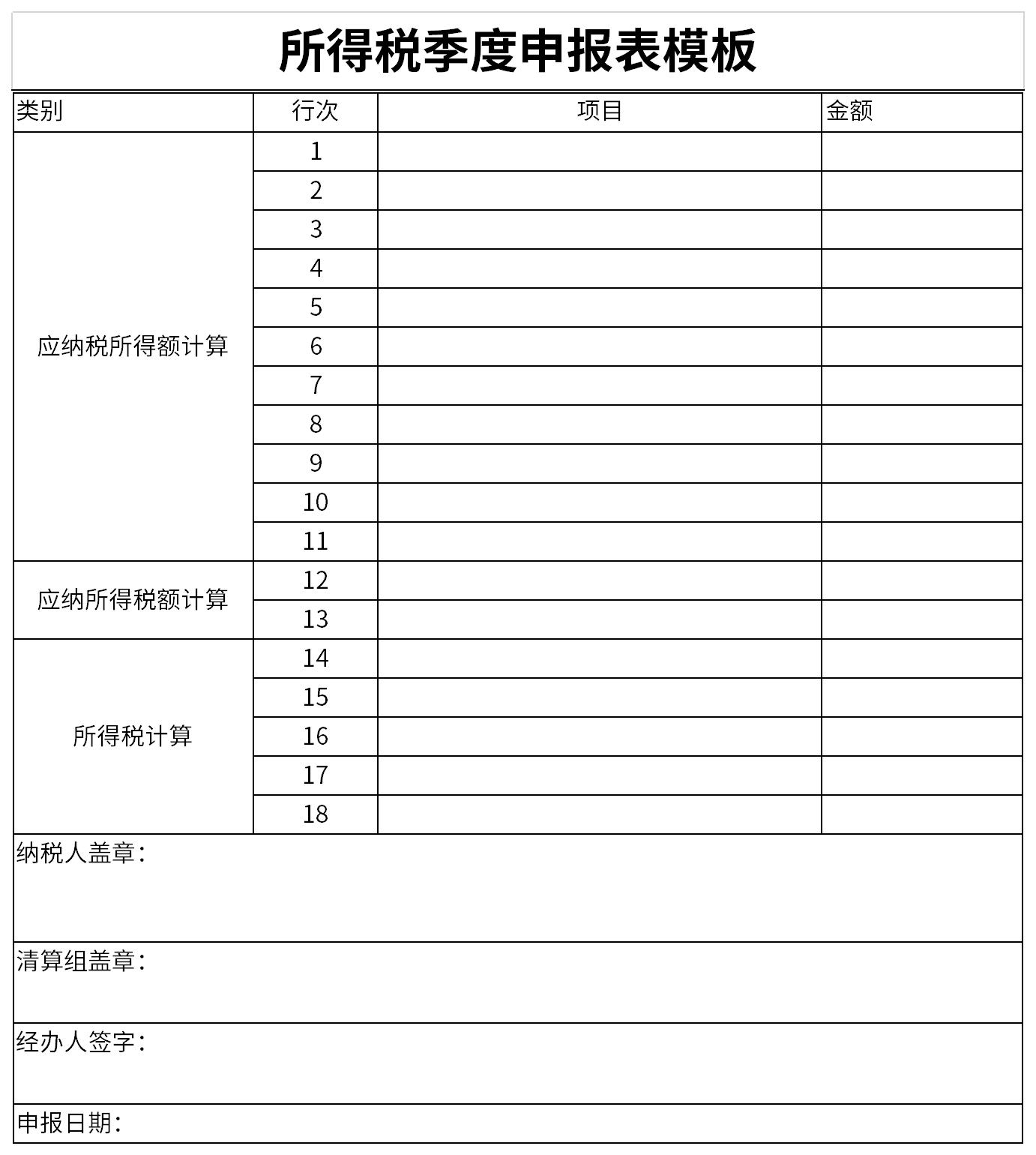

Business Quarterly Income Tax ReturnIt is a free Excel template, download it if you need it! Huajun Software Park provides high-quality Excel template downloads.Elevator accident registration form,Rules and Regulations Legal Review FormDownload to get the source file, which you can edit, modify, and replace. To download the corporate quarterly income tax return, go to Huajun Software Park.

Useful

Useful

Useful