Tips for using the corporate income tax final settlement return form

Tips for using the corporate income tax final settlement return form

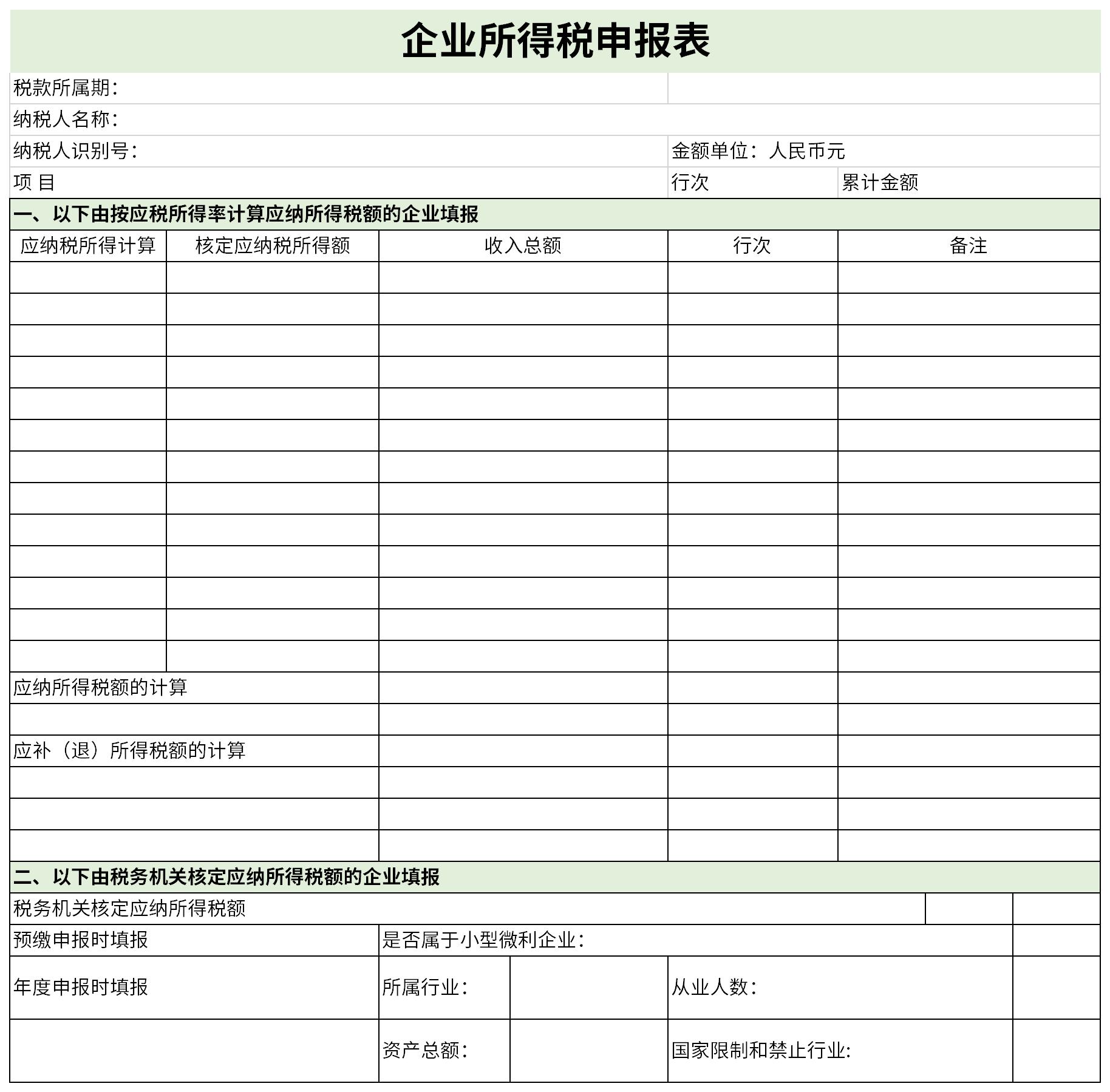

Corporate income tax final settlement return formHow to fill it out?

1. Copy of business license, (national and local tax) tax registration certificate, organization code certificate, and copy of foreign exchange registration certificate (stamped)

2. This year’s balance sheet, income statement, and cash flow statement (stamped)

3. Last year’s audit report, last year’s income tax settlement and settlement assurance report

4. Copies of local tax comprehensive return form and value-added tax return form (stamped)

5. Electronic receipt of all taxes in January (stamped)

6. Copy of corporate income tax quarterly prepayment return (stamped)

7. General ledger, subsidiary ledger, and accounting vouchers

8. Cash count sheet, bank statement and balance reconciliation sheet (stamped)

9. Fixed assets inventory list, fixed assets and depreciation provision details (stamped)

10. Copies of tax authority documents and relevant supporting documents entitled to preferential policies

In some relatively non-standard tables, there will be a problem of mixing text and numbers, which makes summation difficult.

Enter the formula in cell C12: =SUM(--SUBSTITUTE(C2:C11,"元",""))

Press the key combination to complete.

2: Sum of multiple worksheets

For example, some tables have performance statistics for several months, and Zhang Cheng’s position in each worksheet is the same. Find Zhang Cheng’s commission statistics from a certain month to a certain month.

Enter the formula in cell F5: =SUM('January:April'!C2), and press Enter to complete the filling.

Note: The above reference is supported in Excel, but it seems not supported in WPS. And please note that the structure or fixed position of the numbers in each table is the same before you can use this formula.

3: Multi-region joint calculation

In some worksheets, we do not need to sum continuous areas, but may be summing several discontinuous areas.

For example, there is a table that calculates the totals from January to February, March and May to June.

Enter the formula in cell H2, press the Enter key to complete and fill downwards.

=SUM(B2:C2,E2,G2)Recommended by the editor of Huajun Software Park

Corporate income tax final settlement return formIt is a very practical form, and most of the forms it fills out are for general purposes. If you happen to need to download the corporate income tax final settlement return form, please download it quickly. In addition,Exploration rights and mining rights transfer status table,Pre-examination triage registration formIt is also a good form template. You are welcome to click to download and experience it.

Useful

Useful

Useful