Second-hand house transaction tax calculator area

PC software

Android software

ios software

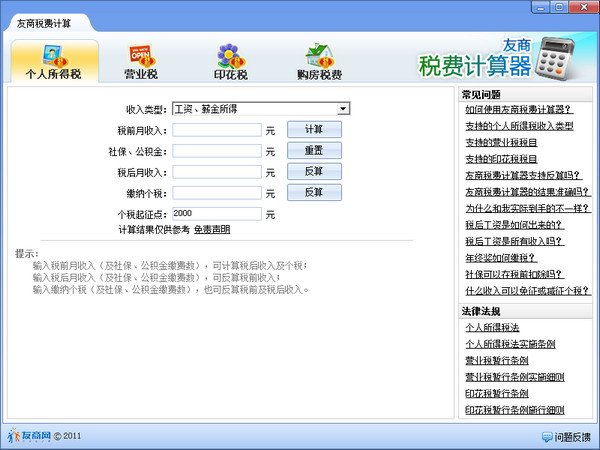

Friendly business tax calculator

2017-10-06

science tools

|

4.9M

|

v1.1.1 latest version

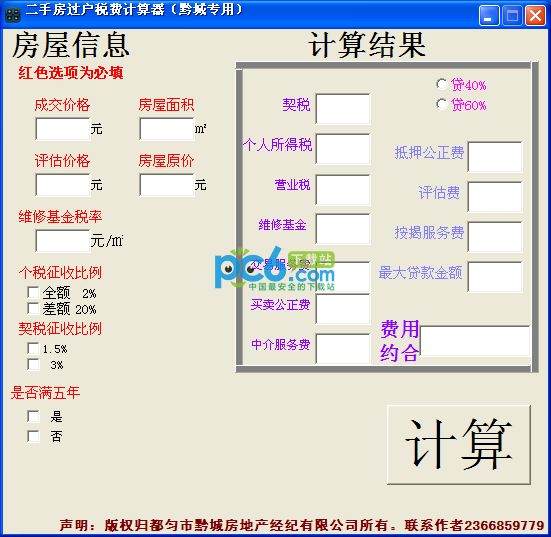

Second-hand house transfer fee calculator

2017-09-27

science tools

|

330KB

|

1.0 Green Free Edition

Wheatfield Online

2024-06-07

system tools

|

50.51 MB

|

3.3.17

Blue room second-hand house

2018-05-02

Life services

|

7.1 MB

|

Sanhe second-hand housing

2018-04-20

Productivity tools

|

81.2 MB

|

traders calculator

2017-09-25

business office

|

24.8 MB

|

1

Second-hand trading supermarket

2017-09-14

business office

|

53.3 MB

|

1

Qfang.com Pro-Software for buying second-hand houses, finding new houses, and renting houses

2017-08-07

Life services

|

84.1 MB

|

5.3.1

Related articles

- How to add blue to Elden's Circle - Guide to adding blue to Elden's Circle

- Where is the Infinite Blue of Elden's Circle - Introduction to the location of Elden's Circle Infinite Blue

- Who is Guangguangfang Shimiao in Shashi Town - Introduction to the background of Guangguangfang Shimiao in Shashi Town

- How to buy a house in Tianya Mingyuedao? Guide to buying a house in Tianya Mingyuedao

- How to get blue coins in Soul Knight? -Vitality Knight’s Guide to Brushing Blue Coins-Huajun Software Park

- How to increase housing in Civilization 6? -How to increase housing in Civilization 6?