In response to this situation, the Cyber Security Bureau of the Ministry of Public Security released a tax refund scam case. How do people get deceived by these scams? And how should we be vigilant and guard against them? Let’s take a look.

“You have a tax refund pending” scam

If you were making a tax refund and suddenly received a text message or email from the tax department, showing that there was a tax refund of several thousand dollars to be collected, would you click the link immediately? Some people not only did not receive the tax refund, but also lost a few dollars because of clicking the link. Thousand dollars.

Police said that fraudsters often use high tax refunds as bait to obtain personal information such as bank card numbers, passwords and verification codes from citizens through phishing websites, thereby transferring property.

During the tax refund process, you must always remember not to click on links to unfamiliar websites. All tax refund matters must be directly handled by the official "Personal Income Tax" app of the National Taxation Bureau.

"Professionals can help you get more tax refund" scam

In fact, in daily tax refunds, some taxpayers do not know much about how to perform tax refund operations, and some people believe in the so-called "professional tax refunds." For example, fraudsters will tell you via phone call or text message: "As long as you provide your individual tax app account password and bank card number, you can help handle the individual tax settlement and refund. You will pay the service fee in proportion to the amount of the tax refund. If you fail, you will not be charged." cost!"

There is only one channel for tax refund, which is the official government affairs platform;

Don’t trust anyone at will, whether they are professionals or people who claim to be able to help you with your tax refund;

Any time you receive such text messages, for example, if you need to click on a link to perform tax refund or other official operations without leaving the official platform, it must be a scam.

"Inducing to fill in false personal tax information" scam

"Nanny-level tutorial on personal tax declaration" and "step by step guide to get money", this type of scam will induce people who need to file tax refunds on the grounds of "taking advantage of preferential tax policies" and "reducing personal burdens", claiming that they can use false qualifications, Provide relevant personal tax refund "services" in the name of others, increase the tax refund amount, and induce victims to pay high fees.

Police reminder

There are many similar strategies on the Internet, but the scam of inducing false personal tax information is fraudulent and will bring risks to personal property and social security that cannot be ignored.

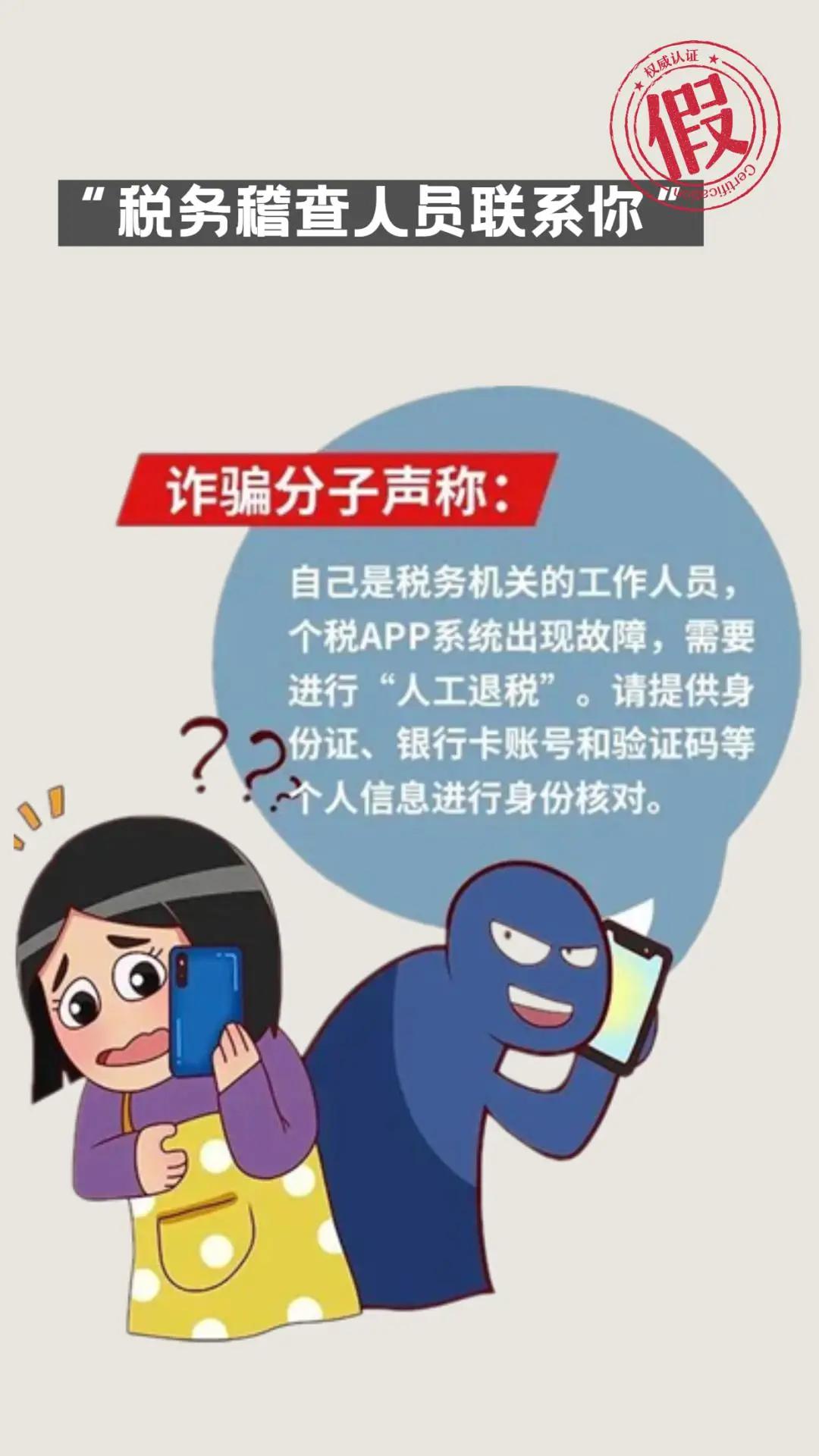

“Tax Inspector Contacts You” Scam

In this kind of scam, fraudsters often pretend to be "tax audit department personnel" and inform you that you have been included in the tax audit list by calling or sending text messages. They will then use chat software to send fake notifications, fake information, etc. to deceive your trust, and then request transfer to a designated account to achieve the purpose of defrauding property.

The police remind that during the fraud process, the scammer may be induced to download relevant software, see the password and verification code you entered by turning on the screen sharing function, and then transfer the money away in the background.

If the tax inspection department carries out random inspections, there will be strict regulations and procedures, and taxpayers will not be notified to provide relevant information through SMS, QQ, WeChat, etc. If you encounter such an incident, please check with the tax department in time.

In addition to the above common scams,Please remember:

Declare and process within the regular "Personal Income Tax" official app, and do not trust unverified refund text messages or emails; do not click on unfamiliar links, and do not easily disclose personal information, bank account numbers, passwords and verification codes; if you are accidentally deceived or encountered In case of suspicious circumstances, please protect evidence and call 110 immediately.