The National Tax Survey System ntss input version is a 2015 tax survey software. Many users want to download, install and use it, but new users do not know how to download and install it. Next, the editor will tell you how to install and use the National Tax Survey System. Hope it can help friends in need.

(1) Unzip the “National Tax Survey” file

Right-click the "National Tax Investigation" file, select "Extract to current folder" and then left-click, a "National Tax Investigation" folder is generated at the current location. The "National Tax Survey" file was successfully decompressed. If there is no "Extract to current folder" option when you right-click, please note that WinRar or WinZip compression software may not be installed on your personal computer. In this case, just download a compression software from the relevant website and follow the prompts to install it.

(2) Add the 2012 National Tax Survey Report Task

Double-click “National Tax Survey Operation System” in the “National Tax Survey/” file to run the National Tax Survey Operation System, as shown in the figure below,

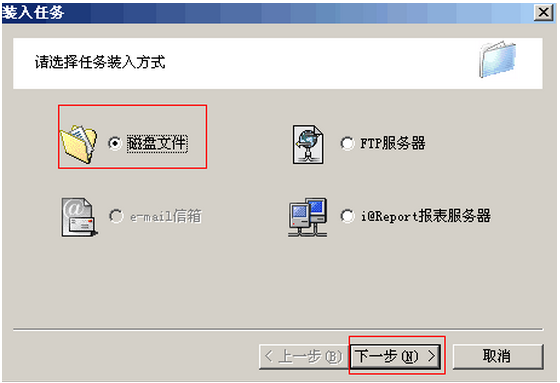

Click "Task | Load Task" in the upper left corner, click Task Menu - Load Task, and select the task loading method. Generally, a disk file is used to load the task, as shown in the figure below:

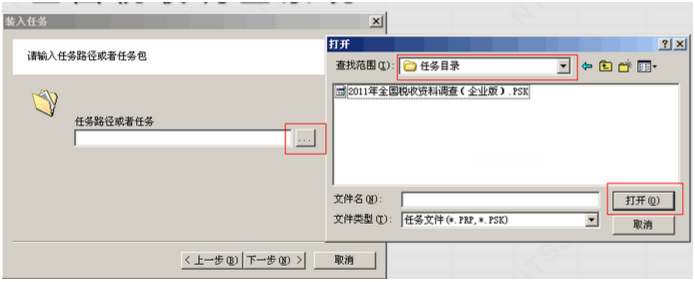

Click "Next", the user is asked to enter the path to load the task package, click

button to select the task package path. In the "National Tax Survey System NTSS Task Directory" under the folder with the path "National Tax Survey Work", select the task package to be loaded - "2011 National Tax Information Survey (Enterprise Edition).PSK" and click Click to open, and then click "Next", as shown in the figure below:

Because when loading a task package (.PSK), the system will decompress the task package into a task directory, that is, *.PRP. Therefore, the system requires you to specify the storage path of the task. The system will give the task a default saving path. If you want to change Path, clickable

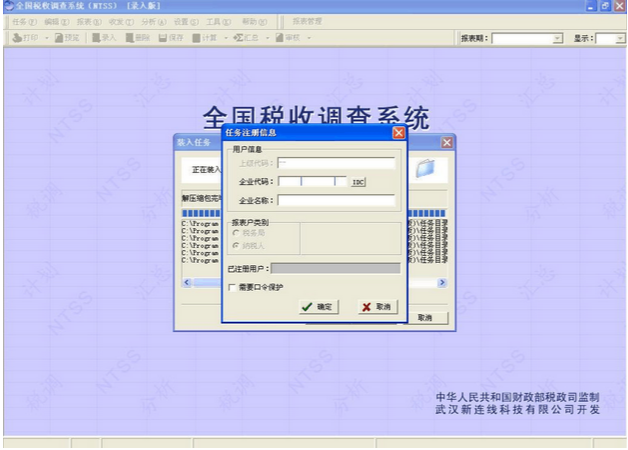

button to re-specify a storage path for the task. Click "Next" again, and the system will start to decompress the task package. After the operation is completed, the system will pop up the task registration dialog box, as shown below:

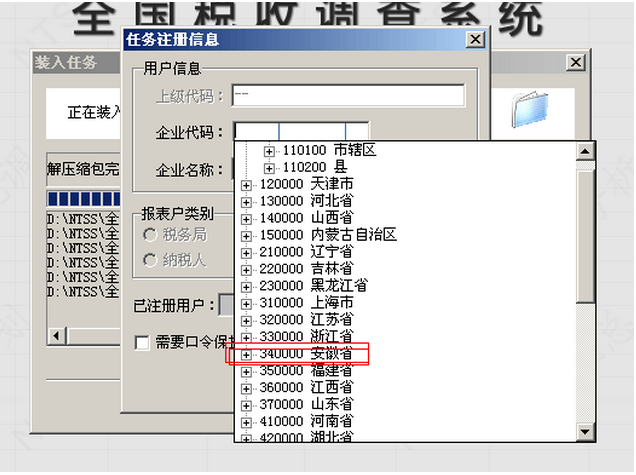

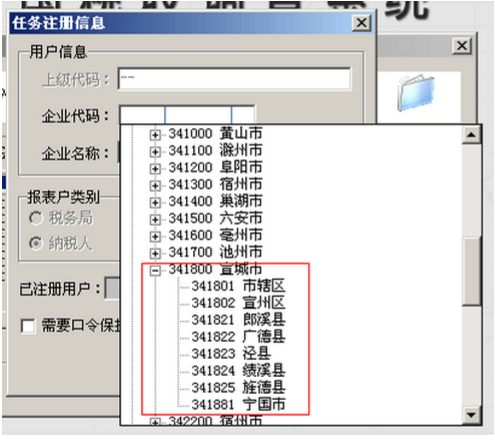

Enterprise code: The enterprise code is the taxpayer identification number, which is divided into three sections. The first section is the code of the competent tax authority. After clicking on this section, click the plus sign in front of each region to select until the specific county or city, as shown below:

The second and third paragraphs are the legal person code, which is the enterprise organization code certificate number. The system will automatically conduct IDC review of the legal person code. If the review fails, the system will prompt. Then enter the company name, complete the registration task information, click the "OK" button, and the system will automatically open the task. After clicking the "Finish" button, click the "Enter" button on the toolbar to enter data in the report.

As shown below:

Tip: After the task is loaded, you can see it in the main menu [Task/Active Task]. Click the task to open it directly.

Here are the use of the national tax survey system installation and use method for you. Friends in need, please come and read this article!